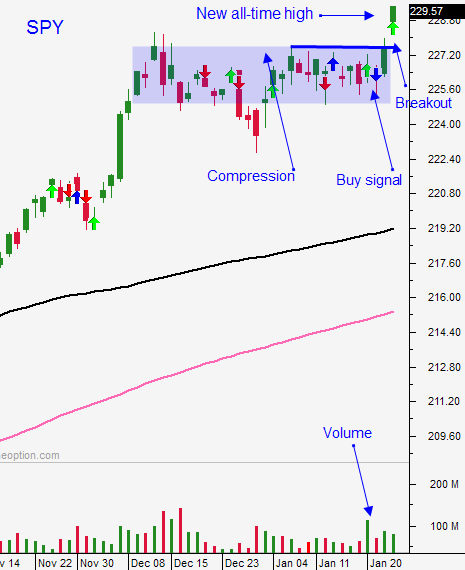

FOMC Statement Today – Buy Calls If the SPY Closes Above $227.60

Posted 9:00 AM ET - Yesterday the market spent the day in negative territory and it reversed late in the day. That momentum has fueled a rally this morning and the S&P futures are up seven points before the open. I've been pointing to a new all-time high for weeks and when we broke out last Wednesday I told you we would see some nervous jitters ahead of the Fed. The breakout was tested and today we will know if it holds. This price action has been very typical.

Apple's earnings report was good and the stock is trading higher this morning. Facebook will post results after the close today. We are getting a slew of earnings announcements this morning in addition to economic releases.

Global flash PMI's were in line and ADP came in at 246,000. That is a "hot" number and we might see a strong employment report Friday.

The FOMC knows the jobs number and it could influence their statement. Job growth has been sluggish the last few months while other economic data points (ISM manufacturing, ISM services and GDP) have been solid.

During its last meeting the Fed said it plans to hike rates three times this year. That is a very aggressive agenda and investors are wondering if economic growth is strong enough to shoulder those moves.

Fed officials like the promise of fiscal spending. For years they've complained that economic growth can't solely be sparked by loose monetary policy. They will be watching to see if Trump can get his plan passed by Congress. If he does, they won't hesitate to raise rates. The Fed knows that ZRIP is not a long term solution and they want to get rates back to a normal level.

I am expecting cautious comments from the Fed with a "wait and see" approach. Analysts believe that the first possible rate hike this year might come in June and the Fed's comments should be consistent with that timeline. I believe the market reaction will be bullish and the SPY will close above the breakout at $227.60.

If the SPY closes above $227.60, buy calls. If it closes above $228.60, take a larger position. This would indicate that the breakout was tested and it held. Furthermore, the gap from last Wednesday will be filled and the market will be back above it.

Do not take a position before the FOMC statement. I urge you not to take a position on the initial reaction either. Wait at least 30 minutes.

If the reaction to the Fed's statement is negative, stay sidelined. I will not take any bearish positions unless the SPY closes below the lower end of the compression ($225). Even then, I will need to see follow-through so I will not be getting short today.

Corporate earnings have been solid and global economic growth is improving. The promise of reduced business regulations and lower corporate taxes will keep buyers engaged.

You know from my comments that I bullish. We got the breakout and this week we tested that breakout. If it holds and we close on a strong note today, the stage will be set for the next leg of this rally. The breakout will be validated and I will get long with greater confidence than I had last week if we close above SPY $228.60 today.

.

.

Daily Bulletin Continues...