Market Is Stuck In the Range – Appropriate For Groundhog Day

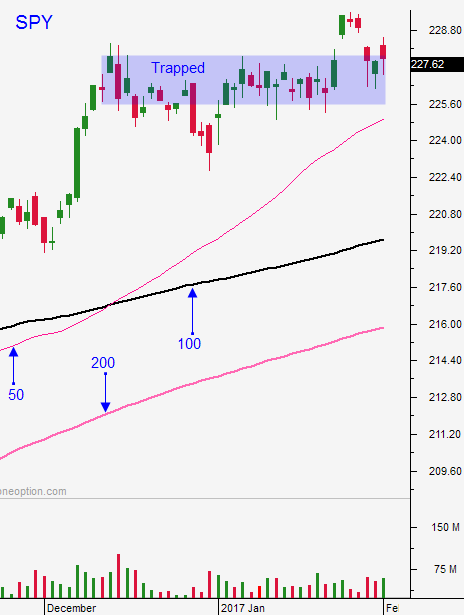

Posted 9:00 AM ET - Once again the market has left us standing at the altar. We had all of the ingredients for a breakout and it didn’t happen. The S&P 500 has been trapped in an extremely tight trading range for two months and this is a low probability environment.

Fed officials said that employment conditions are improving and that growth is moderate. Economic risks are balanced and the decision to keep rates unchanged was unanimous. The reaction was muted and stocks barely moved. Most analysts believe the first rate hike will come in June.

Earnings season is in full bloom and the results have been decent. Apple and Facebook rallied after the news. Today we will hear from Amazon after the close.

This has also been a busy week for economic releases. ADP showed that 246,000 new jobs were created in the private sector during the month of January. This was a "hot" number and it bodes well for tomorrow's jobs report. ISM manufacturing was solid (56.0) and global flash PMI's were in line.

Donald Trump is keeping everyone off balance. The potential for trade wars looms and the White House put Iran on alert.

With all of these events you would think that the market would make a move. I don't care if we breakout or breakdown, we just need to get out of this range.

Sooner or later something has to give. Until the SPY moves below $225 or above $230, we have to keep overnights to a minimum.

I was looking for a nice rally yesterday after the FOMC statement and we didn't get it. Stocks are down this morning and global markets were soft overnight.

Swing traders keep your powder dry. If the SPY closes above $227.60, you can buy a few calls. If we close above $228.60 you can add to the position. If the market makes a new all-time high you can get more aggressive. I still believe the macro backdrop favors the upside so I am not too interested in shorting. Any pullback to the lower end of the trading range will be a buying opportunity.

Day trading has been challenging as well. I find myself struggling with early trades so I'm going to watch from the sidelines during the first hour today. Once the noise dissipates I can find decent trades. I'm back in defense of mode and my targets are passive.

Because the range is so tight, conditions can change very rapidly. We are one strong day from the all-time high and one weak day from breaking major support.

Tread cautiously and use the technical levels I've outlined as your guide. The market will probe for support this morning and it should find it at SPY $226.40. The next support level is $225. Resistance is at $227.60 and $228.60.

.

.

Daily Bulletin Continues...