Job Growth Good – Buy Calls If the SPY Closes Above $228.60

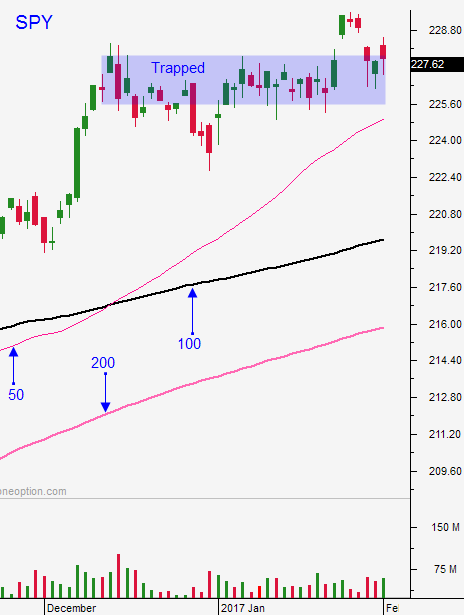

Posted 8:45 AM ET - The market is trapped in a tight range and a busy week of news did not result in a breakout. I am writing today's comments before the Unemployment Report and I don't think it will have much of an impact this morning. Until the SPY closes above $229 or below $225 I will keep my trading activity light.

Traders waited patiently for the FOMC statement. We saw nervous action before the release and the news barely moved the needle. Fed officials unanimously voted to keep rates unchanged. They cited improving labor conditions and balanced economic risks. This should have been a "market friendly" statement.

Major economic releases (flash PMI's, ISM manufacturing and ADP) did not move the market either.

Mega cap tech stocks have been posting results. Microsoft, Google and Amazon traded lower after the news. Apple moved higher and Facebook was flat. In general, earnings have been good enough to keep buyers engaged, but not good enough to fuel a breakout.

Trump's first two weeks have resulted in mixed emotions. Lower corporate taxes and reduced business regulation are good for the market. However, possible trade wars and strained foreign relations are tempering the excitement.

The S&P 500 is wound as tight as I've seen it. We are one good day away from an all-time high and one bad day from breaking through the lower end of this compression. As long as we remain in this range we can expect choppy price action.

Swing traders should stay sidelined until the SPY can close above $228.60. When that happens buy calls and use $228.60 as a stop on a closing basis. If the market makes a new all-time high, add to call positions.

Day traders keep your trade count low and reduce your size. On an intraday basis the market is filled with noise. As soon as a little momentum is generated, the market reverses. This is a very low probability trading environment.

As I mentioned earlier, change can come very quickly. We need a breakout/breakdown and follow through. Once we have it we will know how to position ourselves.

I'm expecting a decent jobs report around 200,000. Trading will be pretty brisk the first few hours and then the action will die down. I do still have a slight upward bias, but the longer we stay in this range the more neutral I am. I expected a breakout after the FOMC statement and we didn't get it.

Support is at SPY $225 and $226.50. Resistance is at $228.60 and $229.60.

.

.

Daily Bulletin Continues...