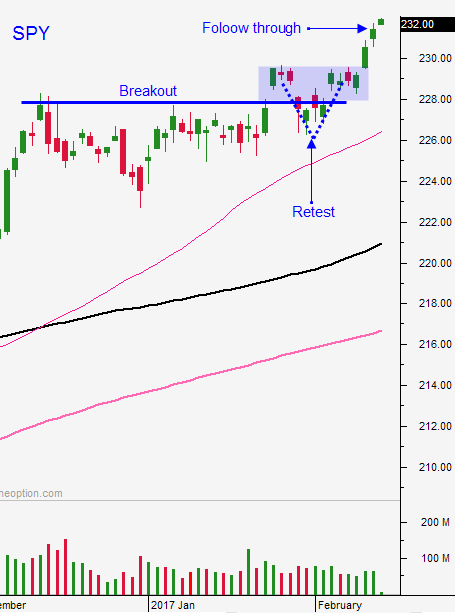

Ride the Market Rally – Still Some Gas In the Tank – Raise Stops

Posted 9:00 AM ET - The tighter the range… the bigger the breakout. We are seeing follow-through buying and the market continues to grind higher. Any Asset Manager doubting this move is scrambling to catch up.

You should be long a boatload of calls and you should be making fantastic money. Last week I told you to aggressively get long. Now you just have to manage profits. We are going to move our market stop up to SPY $231.60.

The news is tapering off (economic, earnings and political) and there is nothing to stand in the way of this rally. Look for a grind higher this week.

Swing traders should be long calls. We are hitting our target profits from positions the last two weeks and you should be "going to the bank". Our new trades from yesterday are off to a great start.

This is a very important lesson regarding option buying. Option Chat has many new members and I want to make this crystal clear. There are only a few times a year when buying options works. You MUST have market momentum and predictable market movement. This tailwind fuels the stock and it exponentially increases our probability of success.

We can always find fantastic stock set-ups, but we need the market. In the last 18 months the market has been trapped in a range and option buying has NOT been rewarding.

There is a great deal of excitement after nailing all of these trades in the last two weeks. Know that this will not last! There will be very long stretches this year when I will advise you not to trade at all. The research will look fantastic and the stock will line up perfectly. However, without help from the market the vast majority of these trades will not work out. In a typical year we might only see conditions line up a few times. That means 90% of the time we are on the sidelines waiting.

Most traders go wrong when they continue to trade the same size under all conditions. They just keep plugging away and eventually the gains turn into losses. Discipline will determine if you make money this year.

This rally could last a couple of weeks, but it will run out of steam. I will let you know when it's time to trim your size. Make sure you do so and consider not trading at all. Hold onto your gains and don't let go until we have another perfect set up.

Your biggest losses will come after your biggest gains. Do not give this money back!

Time decay, decreasing option implied volatilities and wide bid/ask spreads make option buying a low probability strategy. That does not mean it doesn't work. It does mean that you have to use extreme prudence. Limited risk and unlimited report are the benefits that lure most traders to the strategy. Enjoy the run and prepare to put the brakes on when this rally stalls.

Day traders should be patient in the first 30 minutes. Once the dust settles and support is obvious, start scaling into long positions. This morning we will have a flat open. We need to let the market determine a direction. If we grind higher out of the gate, scale into long positions. If we pullback, wait for support and then scale into longs.

We've seen nice gains and there should still be some gas left in the tank. Look for a bullish bias the rest of the week.

.

.

Daily Bulletin Continues...