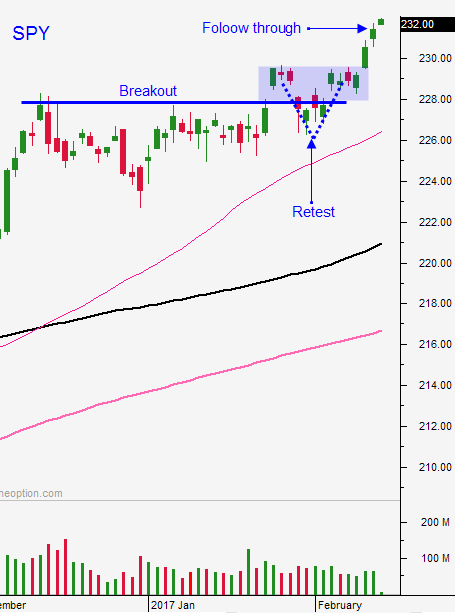

Watch For This Bullish Pattern – Ride the Wave and Use Trailing Stops

Posted 9:00 AM ET - The market has been on a great run and the momentum points higher. Stocks rallied hard on Monday and we saw a brief round of profit-taking Tuesday morning. Buyers quickly stepped in and we closed on the high the day. Bull markets are characterized by lower opens and higher closes. The price action should remain bullish the rest of the week, but we are likely to pause along the way.

You should be long calls and you should be making a ton of money. This is likely to be one of the best stretches you will see all year. We don't currently have to worry about a rate hike, but we will in a couple of months.

Swing traders manage your profits. This breakout could continue for a while so we don't want to limit our profits by setting targets. Instead, we will raise our stop along the way to protect profits.

Use SPY $232.30 as your stop on a closing basis.

Earnings season has been good, global economic conditions are improving, Trump's policies will be business friendly and the Fed is not likely to hike before June. The macro backdrop is bullish and there's nothing to stand in the way of this rally.

Asset Managers who are under allocated are bidding for stocks. That means dips will be brief and shallow.

Day traders need to be patient this morning. Let the market probed for support during the first 30 minutes and then scale into long positions. If you followed my advice yesterday you made a ton of money. If the market makes a new low after the first hour of trading would be a warning sign to reduce your activity.

Stay long and ride the wave.

.

.

Daily Bulletin Continues...