Calls Are Making Money – Manage Your Profits – Move the Stop Up

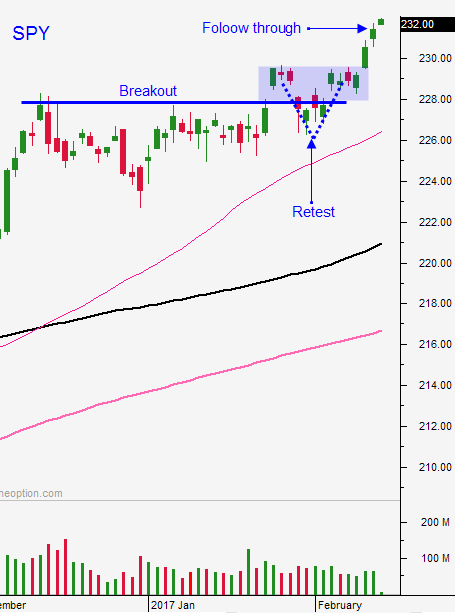

Posted 9:30 AM ET - If you followed my advice last week you are long calls and you're making great money. We bought calls when the SPY rallied above $228.60 and we added when the market traded at a new all-time high. We have follow-through and the momentum is strong. Stocks are up before the open and this should be a good day for us. Let's move our market stop up to SPY $230 on a closing basis.

The breakout from a few weeks ago was tested and validated. We bounced off of SPY $227 and rallied through the all-time high. This is very bullish price action.

Economic conditions are improving and interest rates are not likely to rise until June. The promise of lower corporate taxes and reduced business regulation has investors excited. The macro backdrop is bullish.

There are only a few times a year when you can spread your wings. Much like a professional blackjack player, you have to wait until the probability of success is high. When this happens you increase the size of your bet. Last week I used the word "aggressive" when I told you to buy calls. I rarely do this.

Swing traders should have a full boat. Now it's time to manage profits. We are going to raise our stop and we will watch for signs of resistance. As the market continues to grind higher we will raise our safety net to protect profits.

Day traders are also making great money in the chat room. I don't like up opens, so I will be patient the first 30 minutes of trading. Any probe for support should be brief.

Stay long and manage profits. I believe the market will grind higher the next few days. There is nothing to stand in the way of this rally.

.

.

Daily Bulletin Continues...