Take Profits When You See This – It Will Mark A Short-term Top

Posted 9:00 AM ET - Open on the low and close on the high. That is a very bullish pattern and we've been in it for the last week. The S&P 500 is down five points before the open and you should know the game plan by now.

Day traders, be patient and wait for support to be established. When the market stops going down, start scaling into long positions. We have been killing it in my day trading chat room.

Down opens don't scare me, in fact I welcome them. They help me identify relative strength and I have time to line up my longs. Once support is established, the market slingshots higher. Prices get a little over-extended into the closing bell and the pattern repeats the next day.

An opening gap higher will end this rally and you should take profits when the market peaks that day. Bullish speculators are already piling in. Those who feel like they've missed the move will resort to panic buying on a gap higher. Profit-taking will set in and the selling pressure will accelerate as bullish speculators get flushed out. Once that momentum is established we will hit an air pocket and that high will be intact for at least a few weeks.

Asset Managers are still playing catch-up and the bid has been strong. Every dip is being soaked up quickly.

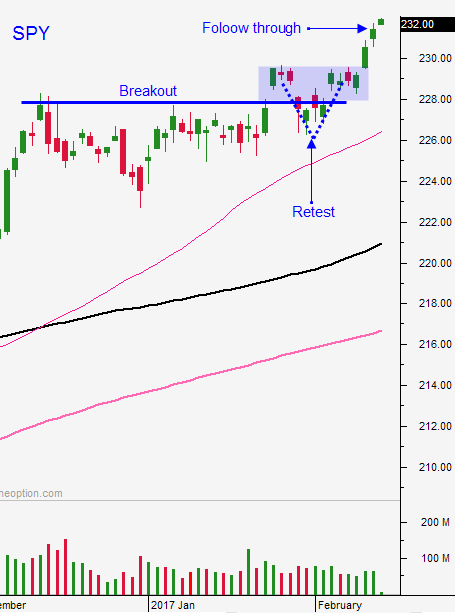

It would be unusual for a down open to gain traction this early in the cycle. The market just staged a major breakout and there is still room to run. If by chance we make a new low after the first hour of trading, take notice. That will be a warning sign and you should trim your size and let the market come in. Selling into the close would be bearish.

Swing traders following my advice are making a killing. We bought calls a week ago in the Option Chat room and we are hitting our targets. Raise your stop to SPY $233.50 on a closing basis.

We will not see the gap higher today, but you need to watch for it. When the market gaps higher be ready to take profits on your positions. Let the market run that day and when the rally stalls sell your calls into that strength.

The ideal scenario is another week of lower opens and higher closes. We want a nice steady grind higher (no melt-ups).

There is nothing to stand in the way of this rally. Economic conditions are improving, earnings have been good, the Fed is sidelined and Trump's rhetoric is not spooking investors.

Look for an early low and a grind higher today.

.

.

Daily Bulletin Continues...