Call Buyers Need To Worry About Compression Not Correction – No Tailwind

Posted 9:00 AM ET - Yesterday was an incredibly slow trading day and the S&P 500 was stuck in a one point range most of the morning. I view this price action as total "noise". Investors are waiting for the next piece of market driving news and we will be trapped in a tight trading range until it hits the wire.

Republicans will be trying to get enough votes together to pass the health care bill in the House this week. Many believe that this is a litmus test for Trump's leadership. To this point the market has given him the benefit of the doubt, but the honeymoon is almost over.

The GOP won't tackle tax reduction until the health care bill is passed. The market has priced in tax relief and this is an important juncture for the new administration. Investors are watching.

Economic conditions are improving and we will get the flash PMI's this week. I'm expecting good results.

The Fed hiked rates last week and the market shouldered the move. When we see the first jobs report with greater than 300,000 new jobs, get ready for the next round of tightening.

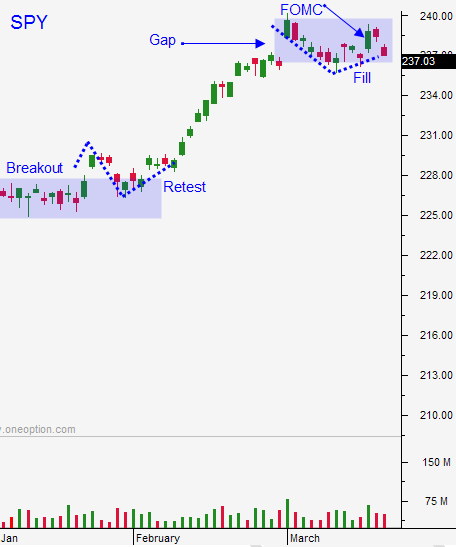

Stocks are chopping around and $237 is losing its relevance since we have been above and below it a few times in the last 2 weeks. Swing traders should move their stop down to SPY $235. If we are going to get shaken out, I want to see a legitimate breakdown. If we don't get a bounce in the next week, we will have to exit our call positions. Time decay will become a factor and the longer we spend at this level the more likely we are to get trapped in a compression. Premium buyers need a market tailwind and we don't have one. I'm more worried about a compression than I am a correction.

Day traders can use SPY $237 as a guide. If the market can't breakout of the first hour range, keep your trading to a minimum. I barely traded yesterday and there were many instances where I would have lost a little money. Day traders suffer death by 1000 cuts in a flat market and it's not worth the risk.

Oil is in positive territory this morning and that will provide a decent backdrop. The S&P 500 is up before the open and we might get a little bounce. Stick with tech stocks. They have been the leaders.

Once the rally this morning stalls, expect a probe for support. There is no compelling reason for buyers or sellers to get aggressive. Set passive targets and take profits early. If we are able to stay above the first hour high, he can get a little more aggressive with longs.

.

.

Daily Bulletin Continues...