Nasty Market Decline – Exit Calls – Still Too Early To Short

Posted 9:00 AM ET - I pound the table when I'm right and I admit when I'm wrong. I didn't see that move coming. Yesterday the market tanked and it breached important support levels along the way. Once the momentum was established it couldn't be reversed and buyers pulled bids. Today we will see if it was a one-day event or if a temporary market top is formed.

The Trump rally has given politicians the benefit of the doubt. Before tax cuts can be considered a new healthcare plan has to be approved. This is Trump's first litmus test and a vote will take place in the House tomorrow. Most analysts don't feel that Republicans have enough votes (hence the market decline).

This is really the only news driving the market. We've been stuck in a tight trading range and this is the current focal point.

Stock valuations are rich and a corporate tax rate cut is priced in. Without it profits will be lower and current valuations can't be justified.

The Fed is tightening aggressively and that is also a market headwind. As long as global and domestic economic conditions continue to improve (likely) the market will be able to shoulder rate hikes.

Swing traders should stop out of call positions. It is still too early to tell if this was a one-day event or if there is more to the move. Consequently, I am not going to buy puts for a swing trade. The trend still points higher and I need to see late day selling and follow through before I start shorting.

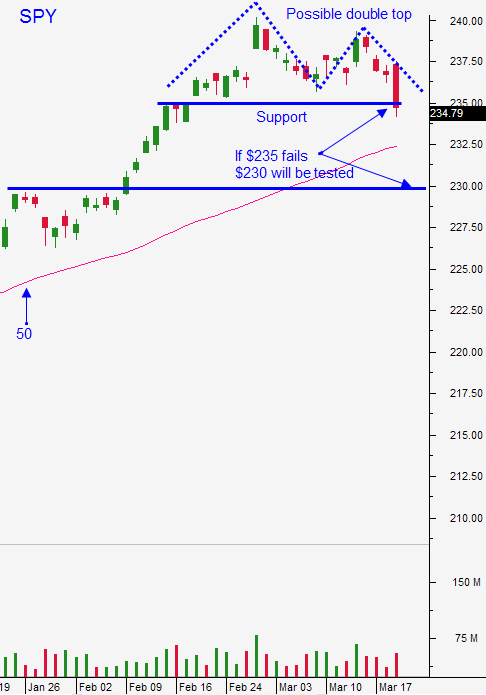

The 50-day moving average is at $232.50 and significant horizontal support is at $230. I want to see if those levels attract buyers.

From a day trading standpoint that reversal was pretty easy to trade. Once we went into negative territory we never looked back. The first hour low was taken out with ease and that was another opportunity to get short. Look for a probe this morning and a bounce. We probably won't see much buying ahead of the vote tomorrow. Traders will wait for the outcome. Use the first hour range as your guide today. If we are below it favor the short side and if we are above it favor the long side.

Rumors about the vote are likely to surface today so be prepared for some quick moves.

As ugly as the price action looked yesterday, realize that once the momentum is set buyers pull bids and that accelerates the move. Bullish speculators get flushed out and that adds fuel to the fire. The news is not as dire as it might seem and if the vote fails in the House politicians will go back to the drawing board.

The most likely scenario at this juncture is a pullback to SPY $230. That will erase the Trump rally and we will fall into a compression. The market was comfortable at that level before the election. Traders will evaluate Trump's progress (or lack thereof) and they will evaluate economic conditions for the next few months. The results will determine where we go next.

.

.

Daily Bulletin Continues...