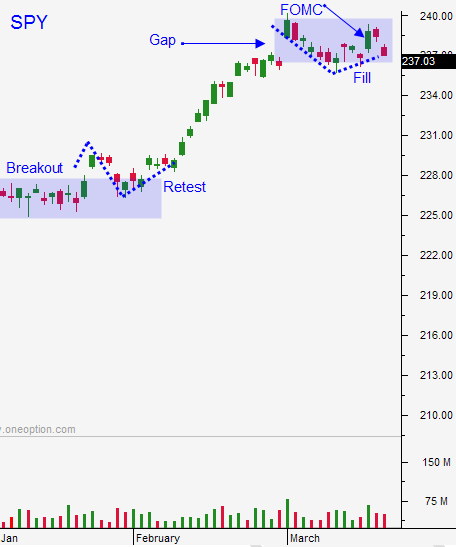

Market Needs To Challenge the High This Week – Range Starting To Form

Posted 9:00 AM ET - Since the FOMC spike last week, the market is gradually been drifting lower. It is difficult to tell how much of this is profit-taking and how much of the drift lower was due to quadruple witching. The market has closed on a weak note the last two days and it is down slightly this morning. SPY $237 needs to hold and we need to see a bounce soon.

We've been in a tight little compression for three weeks and the Trump rally is starting to lose its momentum.

This week the House will try to pass the health care bill. This will be the first litmus test for Republicans. The market has given politicians the benefit of the doubt, but the honeymoon is almost over.

Interest rates were raised .25% last week and the Fed plans to tighten two more times this year. That is an aggressive agenda and we need strong economic growth to absorb the moves. That growth hinges on Trump’s success.

Buyers are excited by the prospect of lower corporate taxes and reduced business regulations. Sellers are taking profits as interest rates move higher. The market is waiting for the next catalyst (up or down).

Swing traders need to watch SPY $237. If the market closes below that level exit your call positions. It is still too early to go short. We need to see technical damage before we start looking at the short side. For now, any dip is still a buying opportunity.

Tight compressions are deadly for option buyers because of time decay. If the market is able to rally back above $238 this week we have a chance to take out the all-time high.

Day traders need to be patient on the open. If the market is trading below $237 after an hour, favor the short side. If the market is above $237 favor the long side. If we get through the first hour range in either direction go with the move. If the SPY stays in its first hour range, trade small.

It's important to note that the SPY paid a dividend of $1.03 last Friday. Consequently, the SPY is not down as much as it might seem. It is actually trading around the old $238 level if you add the dividend back.

The calendar is pretty light this week and the healthcare plan might be the focal point. If politicians muddle around the market will get impatient.

Use SPY $237 as your guide today. Look for quiet trading today.

.

.

Daily Bulletin Continues...