Market Will Bounce – Earnings and Economy In Focus – Tax Reform Has Time

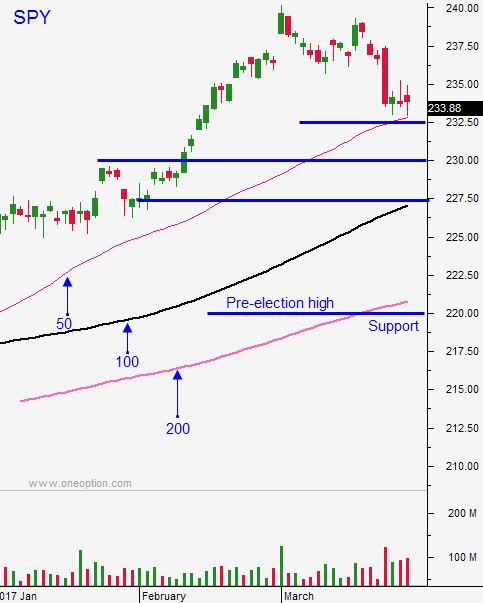

Posted 9:00 AM ET - Yesterday the S&P 500 gapped lower on the open and it was down more than 20 points. The low the day was established in the first 10 minutes of trading and stocks gradually work their way back the entire day. This reversal was bullish and it was a sign that buyers are still engaged. The SPY closed above the 50-day moving average ($233) and we can lean on that support level.

Stocks will test the bid early this morning. If the market bounces immediately we can trade from the long side with confidence. Use SPY $233 as your stop.

Trump's honeymoon is over and investors want results. The healthcare bill never made it out of the House and the market sold off on the news. Tax reform is on the front burner and this should be much easier for the GOP to tackle.

Corporate profits would increase if the tax rate is reduced and this is priced in. Many corporations have moved their headquarters overseas in favor of lower tax rates and Trump plans to reverse this trend. Fiscal conservatives (the Freedom Caucus) have stated that tax cuts do NOT have to be revenue neutral. If tax reform includes a boarder adjustment tax it will be dead on arrival.

Trump needs support from moderate Democrats and he is going to reach across the aisle. A fiscal spending plan could be tied to tax cuts to garner support from the left.

The market priced in tax reform and some of the "fluff" has been taken out in the last two weeks. Trump will have a couple of months to make progress and a repeat performance of the healthcare debacle would be bearish.

Global and domestic economic conditions are improving and they are strong enough to support the recent tax hikes. Earnings were solid and guidance is strong. CEOs are optimistic and Q1 announcements will begin in a few weeks.

Swing traders can start scaling into long positions today if the market makes an early low and it is above SPY $233 after an hour of trading. Use SPY $233 as your stop on a closing basis. I would not add to positions until the market closes on its high of the day and we see follow-through buying the next day. The upside will be relatively contained if conservatives voice their opposition to tax cuts.

Day traders need to wait for support this morning. An immediate bounce would be bullish and you can start getting long. If the market trades below the first hour low wait for support. The reversal Monday was a bullish sign and I believe the downside will be relatively contained today. I don't like chasing rallies in this environment, but I do like buying dips.

The political winds should settle down this week. Trump will buy himself a little time and tax reform is all the market really cares about.

The focus will be on earnings and economic releases for the next month. Provided that DC does not throw a wrench into tax reform negotiations the market should be able to grind higher. Stick with tech stocks since they are strong. After a nasty open, the QQQ finished in positive territory yesterday.

.

.

Daily Bulletin Continues...