Look For An Easy Little Tax Cut – Market Will Get A Sugar High

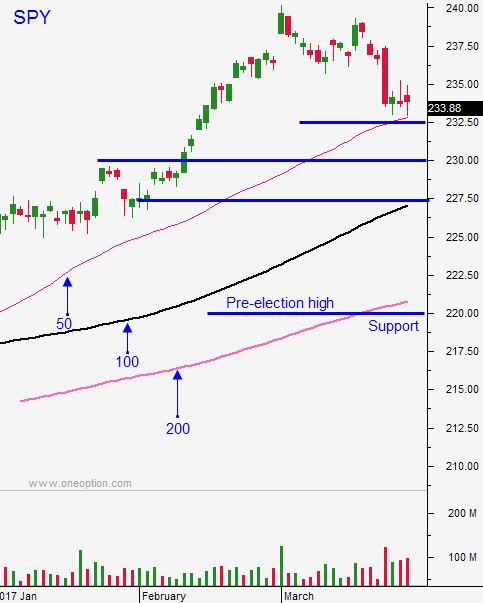

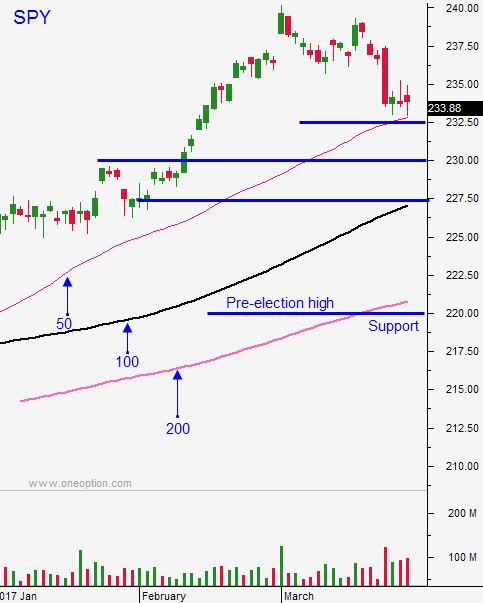

Posted 9:00 AM ET - Yesterday we saw follow-through buying after the reversal on Monday. The S&P 500 was up more than 20 points at one time and it has rallied 40 points since the low Monday. The SPY is above resistance at $235 and that will become a support level we can lean on.

As you know from my comments, I felt the failed attempt at repeal and replace was a blessing (for the market). Healthcare is complex and a solution it will require buy-in from both parties. Trump likes to win and now he can focus on lower hanging fruit.

Tax reform is all the market cares about. Trump wants to put points on the board so look for a quick easy solution. He wants to save face and I expect him to take baby steps. Instead of trying to pass a massive all-encompassing tax reform bill, he will break it into smaller pieces and he will start with components that have bi-partisan appeal.

This is exactly the type of "sugar high" the market loves.

Healthcare reform would have taken many months to approve and it would have been volleyed back and forth between the Senate and the House. Heated exchanges and finger-pointing would have been part of the process.

As it currently stands, Obamacare is in place and no one has to worry about their health care. Tax reform has been put on the front burner.

We will have a number of important economic releases next week (ADP, ISM manufacturing, ISM services and the jobs report). I'm expecting solid numbers. Consumer Confidence was very high yesterday. Monday China will post its PMI and it should be strong. Europe's activity is also improving.

Two weeks from now earnings season will begin. Top and bottom line growth was good in Q4 and CEOs are optimistic. Stocks tend to rally into earnings season.

The reversal we saw Monday shows that buyers are engaged. The market instantly caught a bid and the grind higher was steady. Yesterday we saw follow-through buying and a close near the high of the day. I'm expecting bullish price action today.

Swing traders should have some calls on already. Add to positions today and raise your stop to SPY $235 on a closing basis. That might seem pretty tight, but I want to see continuation. This pullback and reversal could slingshot us to a new all-time high. Rumors of an easy tax cut could surface at any time.

Day traders should look for an early entry point for longs today.

Monday I mentioned that this would be a buying opportunity. It's time to step up to the plate.

.

.

Daily Bulletin Continues...