Market Does Not Believe Trump Can Cut Taxes – Buy On Support

Posted 9:00 AM ET - Last Friday Republicans pulled the healthcare bill knowing that they didn't have enough votes in the House. This casts doubt on Trump's ability to execute his game plan and the market doesn't like the news. The S&P 500 is down 20 points before the open and the 50-day moving average will be tested.

Tax reform will go to the front burner and skeptics believe that it has just as many roadblocks. I disagree.

The Freedom Caucus blocked the healthcare bill. However, their chairman (Meadows) said that tax cuts do not have to be revenue neutral. This means that BATS (boarder adjustment tax) does not have to be part of the tax reform. The Freedom Caucus has their first defection (Poe) and they need to tread cautiously. If Republicans want a win, they better leave BATS out of the plan.

Repealing Obamacare would have been a giant slap in the face for Democrats and they defended rigorously. Trump has been bashing it since he started running for office and I understand why the claws came out. It will be much more difficult for Democrats to explain why they oppose everyone having more money in their pocket. I don't see them standing in front of the tax cut freight train with the same vigor.

Most working Americans know that high taxes are forcing corporations to move their headquarters overseas and they want to stop this trend. Much of our economic activity is generated by small businesses and a tax break will spark investment.

From my perspective the healthcare plan would have postponed the tax cut for many months. The Senate and the House would have volleyed this bill back and forth for many months. As it stands currently we have the same health care plan. When Obamacare starts to crumble Democrats will come to the table and the necessary reforms can take place on a bipartisan basis.

Today's market decline has to do with Trump's credibility. He tried to bite off too much by tackling healthcare. He will blame "the swamp", cut his losses and move on to a battle he believes he can win.

Politics drives the market these days so I have to mention it.

From the record high a few weeks ago we still have the same healthcare plan, we still have solid global/domestic economic growth, earnings projections remain strong and CEOs are optimistic. Energy stocks have weighed on the market but oil prices should stabilize. There is a silver lining to low oil prices. It is a pseudo tax cut for consumers.

Interest rates are moving higher and the Fed has an aggressive tightening agenda. They claim to be market neutral, but they hike rates when they feel the market can shoulder the move. If this market decline is sustained, they will hold off on the next hike.

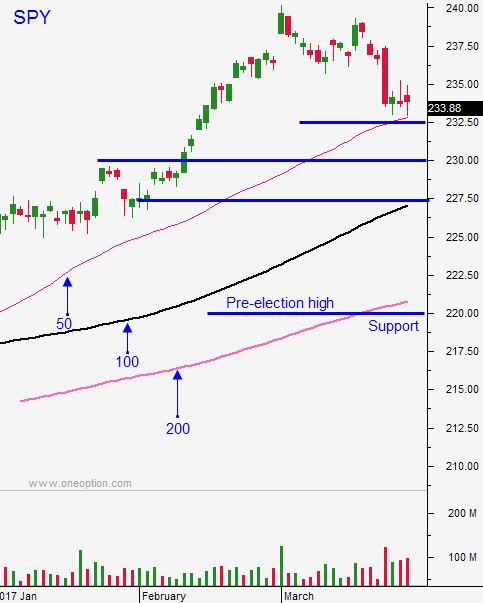

I believe this will be an excellent buying opportunity. Swing traders need to be patient. Wait for support and start buying calls. Support levels are SPY $232.50, $230 and $227.50. The first support level will fall pretty easily this morning. If I see a deep air-pocket, a swift reversal and a close above $232.50 I will buy a few calls. I am not overly anxious to get long today.

Day traders need to be cautious on the open today. I believe we will probe for support early. If the market continues to drift lower after the first hour of trading we could be in for a nasty day. I will look for shorts, but much of the move will be priced in right on the open. Relative strength will be easy to spot and I will be more interested in scooping those stocks. Day traders need to shy away from inversely correlated stocks and defensive plays (gold, utilities...). They will look strong early but that is only because of the market decline. If the market bounces they will pull back. I will be looking for tech stocks that are holding up well.

The market trend is up. I will not take any overnight shorts until serious technical damage has been done over an extended period of time. Until that happens, every market pullback will be viewed as a buying opportunity. We just have to be patient and wait for support.

I will be licking my chops if we get down to the 100-day MA at SPY $227.50 this week.

.

.

Daily Bulletin Continues...