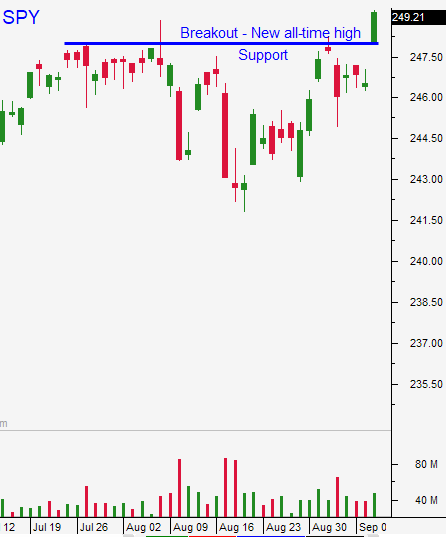

Market Will Grind Higher – Watch For This Pattern

Posted 9:30 AM ET - The market has broken through resistance cleanly and we saw follow-through buying yesterday. The news is fairly light and momentum will push stocks higher. This rally should last a few more weeks. We want to see a pattern of lower opens and higher closes.

There are only two potential speed bumps. The first is a week from today when the FOMC releases its statement. Investors have priced in a December rate hike and balance sheet reduction. Any mention of inflation due to reconstruction in Texas and Florida would be slightly bearish.

The second issue is North Korea. We can't predict when they might resume missile launches and temporary pullbacks are possible at any time.

China will post its retail sales and industrial production tomorrow morning. I am expecting decent numbers.

The debt ceiling will be extended and the focus is on tax reform. This is something all Americans want and Trump will do everything in its power to get it done. If DC can’t get it done we will chop around with the expectation of it happening. If tax reform is passed we will see a big leg higher.

Expect three steps forward, two steps backward process for now.

Swing traders should be long calls. Use SPY $248 as your stop on a closing basis. As the market continues to push higher, raise your stop.

Day traders should wait for support this morning. We've had a nice run and we could see a little weakness. Once the selling abates, start scaling into long positions. Use the first hour high as your guide.

I was hoping for a pullback to the 100-day moving average. A dip of that magnitude would have provided fantastic momentum off of that reversal and we would have loaded up on calls. The SPY would have rocketed through the all-time high. We didn't get the pullback so we won't get nearly as aggressive. This rally will gradually grind higher and there will be a number of "dead spots". Ride your calls and trail your stops higher.

.

.

Daily Bulletin Continues...