Market Breakout Could Be Tested Ahead of the FOMC – Buy Dips

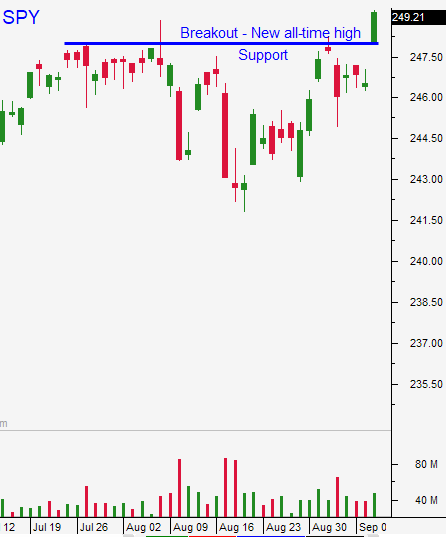

Posted 9:00 AM ET - The market broke out to a new all-time high on Monday when hurricane damage was less than expected. Since then the trading ranges have been extremely tight during the day. Gains will consolidate ahead of the FOMC statement next week and the breakout could be tested.

The market is prepared for balance sheet reduction and a rate hike in December when the Fed meets next week. Any mention of hurricane induced inflation might spook investors. That would signal additional tightening in 2018. The CPI came in a little hot (.4%) and the market reaction this morning was negative.

Trump had dinner with key leaders from both sides last night. DACA, the wall and tax reform were the topics. Trump is demonstrating a willingness to work with Democrats (debt ceiling extension) and that is a positive development. The chances for new legislation are improving and this will provide a bullish backdrop for the market.

China's industrial production was a little light and retail sales were in line.

Initial jobless claims are spiking because people are applying for unemployment after the hurricanes.

The market has broken out and it has been able to hold the gains. Swing traders should be long calls and they should use a close below SPY $248 as a stop. Any dip will represent a buying opportunity.

Day traders need to be patient. After the first hour of trading the SPY has been trapped in extremely tight ranges. Reduce your size and trade count. Trade from the long side and set passive targets. In my comments yesterday I mentioned that bullish markets open lower and close higher. I am expecting this pattern today.

We will have quiet trading with a slight upward bias during the next week.

.

.

Daily Bulletin Continues...