Market Will Gradually Grind Higher Next Few Weeks – Stay Long

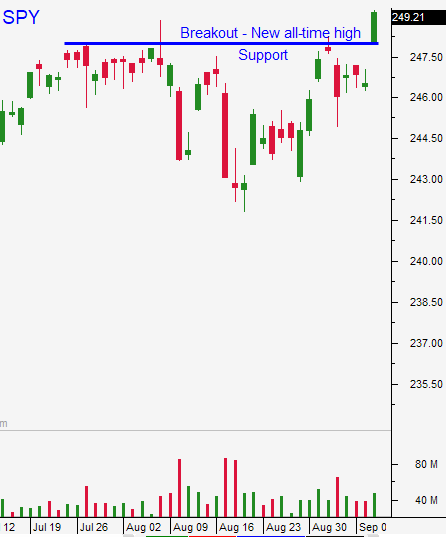

Posted 9:00 AM ET - My headline yesterday said to buy calls. If you took my advice you made money. The market has broken out to a new all-time high and the price action this morning suggests follow-through.

Hurricane Irma was not as damaging as feared and North Korea has not had any missile launches in the last few days.

The debt ceiling has been extended and this was a major development last week. Trump is showing a willingness to work with Democrats and tax reform is on the front burner. He is hosting a dinner (leaders from both parties) that will be focused on tax cuts. A number of rallies are also planned and tax cuts will be the primary topic.

Economic data points have been good. China will post industrial production and retail sales this Thursday (numbers should be good).

There are signs of inflation and reconstruction after two major hurricanes could push prices higher.

The FOMC meets a week from tomorrow. They will reduce their balance sheet and prepare the market for a December rate hike. The Fed plans to gradually tighten and inflation could accelerate the process. Investors seem comfortable with the December timeline.

The market will grind higher and we won't get the explosive move I was hoping for. We needed a nice pullback to the 100-day moving average for that to happen. Instead, we will creep higher and the action will be relatively subdued once this initial move runs its course.

After this move (SPY $255) the market will be choppy. If tax reform is passed we will get a nice year-end rally ($270). If not, the SPY will be trapped in a range.

Swing traders need to buy calls. The momentum from this move will probably be the best opportunity we see the rest of the year. Next week's FOMC meeting is the only potential speed bump. Use a close below SPY $248 as your stop. Any dip will be a buying opportunity.

Day traders should focus on the long side. Buy strong stocks early in the day and use the first hour low as your stop. If the market is above the first hour high you can get more aggressive and use that as your stop.

The calendar remains light and momentum favors the upside. Stay long.

.

.

Daily Bulletin Continues...