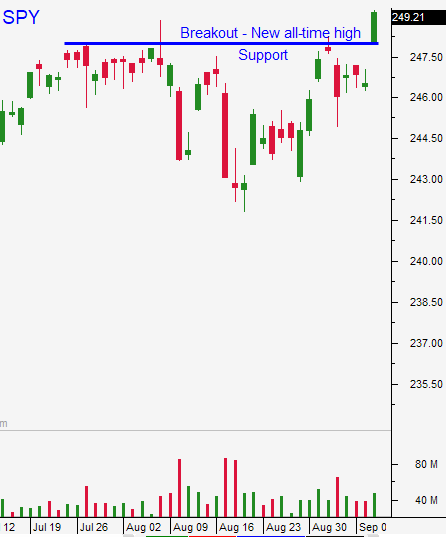

Market Has To Stay Above This Key Level – Stay Long

Posted 9:30 AM ET - The market broke out to a new all-time high Monday and it is been consolidating gains the last few days. Trading ranges are extremely tight during the day and the volume has been light. This is likely to continue until the FOMC statement next Wednesday.

North Korea tested missiles last night and the market is starting to ignore the news. The S&P 500 is barely down on the open.

Economic releases have been consistent with decent growth.

Earnings season was excellent and guidance was strong.

The debt ceiling was extended and the focus is on tax breaks. Any progress will spark a rally.

A December rate hike is priced in along with balance sheet reduction. The market is comfortable with the next move and any dip ahead of the announcement will be a buying opportunity.

Swing traders should be long calls and they should use SPY $248 as a stop on a closing basis. Yesterday we saw rotation out of tech and into other sectors. That is why the QQQ was down and the SPY was flat.

Day traders should wait for the market to find support this morning. Start scaling into long positions and try to make your money early in the day. Set passive targets and use $248 as your guide. I prefer down opens because relative strength is easier to spot and my entry point is on a dip/compression.

This could be a very quiet day and we could see light trading the next few days.

Stay long.

.

.

Daily Bulletin Continues...