FOMC Will Be A Non-Event – Stocks Will Grind Higher After the News

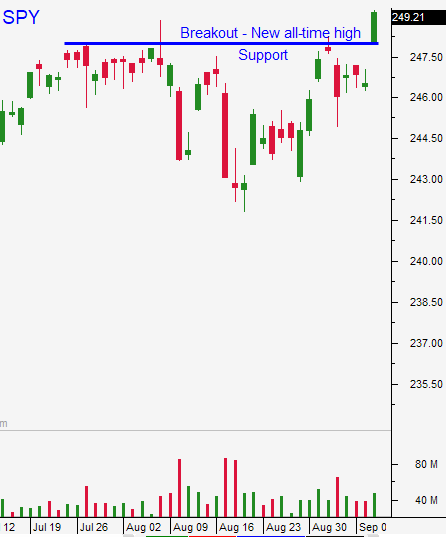

Posted 9:00 AM ET - The market has been treading water near the all-time high. This Wednesday the FOMC will release its statement and we can expect a rate hike in December. The market breakout from last week should hold and any dip will present a buying opportunity.

The debt ceiling has been extended and Trump has shown a willingness to work with Democrats. Politicians know that a tax bill is on the front burner. Any progress (or rumor thereof) will fuel a rally.

Earnings season was good and guidance was stellar.

Economic data points have been consistent with moderate growth.

Swing traders should be long calls. Watch for nervous trading ahead of the FOMC and a grind higher afterwards. My target is SPY $260 in the next month. A tax deal would quickly push us through that level if it happens. I don't want to get overly aggressive with my longs when the market is at an all-time high.

Ideally the 100-day moving average would've been tested and that would have provided an excellent opportunity to aggressively buy calls. The window for that drop has passed. Global credit conditions are stable (Portugal’s rating was just raised to investment grade).

Day traders need to be a little cautious when the market opens higher. Let the early action settle down and scale into long positions once the bid is established. Use the first hour high as your guide. Down opens are much easier to trade. Relative strength stands out like a sore thumb and the entry point is excellent. I am more aggressive with my trades on these days.

Stocks will be "dead till the Fed". After the Fed announcement the market will find its footing and grind higher next week.

.

.

Daily Bulletin Continues...