Tax Deal Likely – Any Progress Will Fuel a Market Breakout

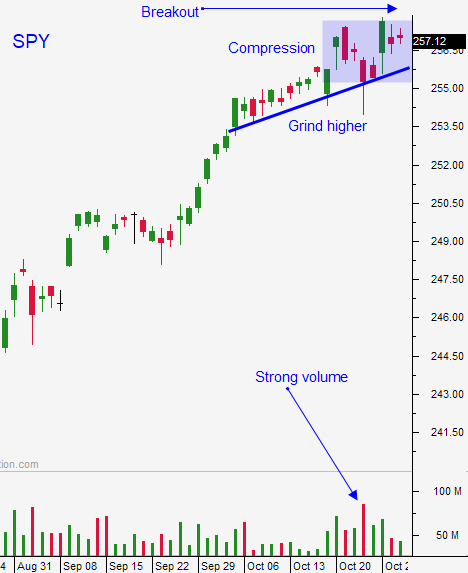

Posted 11:00 AM ET - Yesterday the market opened with a bang and then retreated. Of the last nine opening rallies eight have failed. This is not the bullish price action I have been looking for during the strongest two week period of the year. Stocks rebounded Thursday and that reversal has some follow-through this morning. The breakout needs to happen in the next day or two or I will start reducing my longs.

Mega cap tech stocks always spark optimism. Apple posted good results and the stock is up 4% overnight. This will boost the tech sector. Now that tech giants have posted earnings, the excitement will wane. With the exception of Facebook, the reactions have been very positive. In general companies have exceeded bottom line expectations by 9% and this is a healthy margin.

Powell will be the new Fed Chairman and the market is comfortable with the news. The reaction to the FOMC statement was muted and investors are ready for a December rate hike.

The Unemployment Report posted 261,000 new jobs in October. This was a neutral number. Analysts were expecting better, but it will get a free pass for another month because of the hurricanes. ISM services will be posted after the open and I am expecting a good number. ISM manufacturing and GDP were excellent.

Trump's tax plan looks good. There have been concessions and I believe it will get passed this year. Republicans only need 51 votes and they might even attract a few red state Democrats. Tax cuts are all the market cares about and the possibility of a deal will prevent any major declines.

Swing traders need to hold the course for a few more days. Hang onto your calls and wait for that breakout. The tax cut safety net should give you some peace of mind. The market has plenty of good news plus seasonal strength.

Day traders need to be very cautious. If the market probes for support...buy dips. This strategy worked yesterday and it has been working for weeks. Intraday volatility has plunged 49% this year. In a Wall Street Journal article we learned that Goldman Sachs will not be making markets in equity options. Revenue in an equity derivatives business that focuses on listed options shrank by 41% in the U.S. and by 28% globally during the first half of 2017. I have been making my money on swing trades. This is a tough day trading environment.

I want to see the early rally this morning gain traction. I have a hearty call position and I will start paring it back if we don't get to push the next few days.

.

.

Daily Bulletin Continues...