Window For A Market Rally Is Closing – Reduce Risk Friday

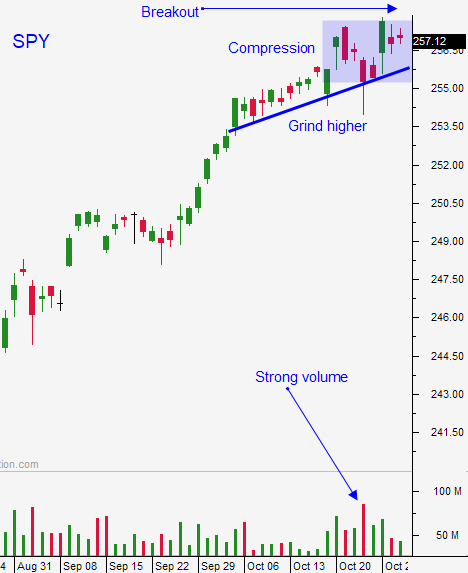

Posted 10:00 AM ET - The theme this week has been "now or never". Stocks have all of the good news they need to move higher and the rally needs to happen this week. If we do not get a breakout the market will compress in a tight trading range.

Let me add one caveat to that forecast. If the market does not breakout this week and Congress passes tax cuts the rally will take place. The extent of the move depends on the details. Republicans will release their plan this morning. Rumor has it that state local tax deductions (SALT) should be the remaining "sticky point”.

Earnings season has been excellent. On average companies have exceeded bottom line expectations by 9%. Good news was priced in, but this is a substantial margin of victory. Facebook is relatively flat after posting yesterday. Apple will report after the close today. The strongest companies announce early in the earnings cycle and optimism builds. Buyers are not chasing stocks at the all-time high and earnings season has not been much of a "driver".

The FOMC statement yesterday was benign. The Fed's desired level of inflation is below the target (dovish) and they see tightening labor markets. Analysts are prepared for a rate hike in December. Trump announced that Powell will be the new Fed Chairman. The market seems comfortable with his decision.

The economic news this week has been excellent. ISM manufacturing came in at a robust 58.7. ADP showed strong job growth in the private sector during October (235,000). The consensus estimate for the jobs report is 285,000 on Friday. GDP growth was 3% last week and that is also a strong number. Economic growth will benefit from hurricane repairs in coming months.

In addition to seasonal strength, we have end of month/beginning of the month fund buying. The last week of October and the first week of November have historically been two of the most bullish weeks of the year.

In short, if we don't rally now we won't get much of a move into year-end. All of the pieces are in place.

Swing traders should be long calls. Use SPY $255 as a stop on a closing basis. If we don't get the breakout by the close on Friday I am going to start reducing my overnight longs. The tech sector usually moves well during the early part of earnings season and these stocks have been very sluggish. After AAPL tonight, all of the mega tech stocks will have reported.

Day traders need to be cautious when the market opens higher. I mentioned this in my comments yesterday. The early rally reversed and the market flat lined most of the day. I am only day trading when the market opens in negative territory. I wait for support and I start scaling in to S&P futures/NASDAQ futures when my market rating improves. Most of my money has been made swing trading in the last 2 months.

My overnight exposure has been greater than I'd like, but this is a very bullish time of the year. The breakout needs to happen now or I will start reduced my exposure.

Let's see if all of the good news will translate into a nice grind higher.

.

.

Daily Bulletin Continues...