SPY $260 Or Bust – Market Needs To Rally Above This Level Now

Posted 9:30 AM ET - Last Friday the market poked through the all-time high. Economic numbers were good, earnings were solid, the FOMC statement was balanced and Republicans released their tax cut plan. This is the most bullish seasonal period of the year and if we do not see follow-through buying I'm going to reduce my call positions.

The Unemployment Report showed that 261,000 new jobs were added in October. This was a little "light", but traders will give the number of free pass since hurricane repairs are just starting. ISM services and ISM manufacturing were very strong.

Earnings season is "front end loaded". On average companies have exceeded profit expectations by 9%. This is a healthy margin, but the strongest companies have posted. The excitement will wane in coming weeks and that is why we need the market to lift-off now. Q3 earnings releases climaxed last week.

The FOMC statement was benign. Inflation is below their target (dovish) and labor conditions are tightening (hawkish). Traders are comfortable with Janet Yellen's replacement (Powell) and two new Fed Officials will be selected (Fisher and Dudley retiring). We will get another rate hike in December.

Republicans released their tax plan last week and the Senate will make changes. State and local tax deductions (SALT) will be one of the sticking points. Tax cuts only need 51 votes to pass in the Senate. Red state Democrats up for re-election could be the key and Republicans will need every vote. As long as the possibility exists the market will tread water. Tax cuts are the only remaining catalyst.

The news is going to start tapering off this week. We can expect tough rhetoric from Trump after he leaves China.

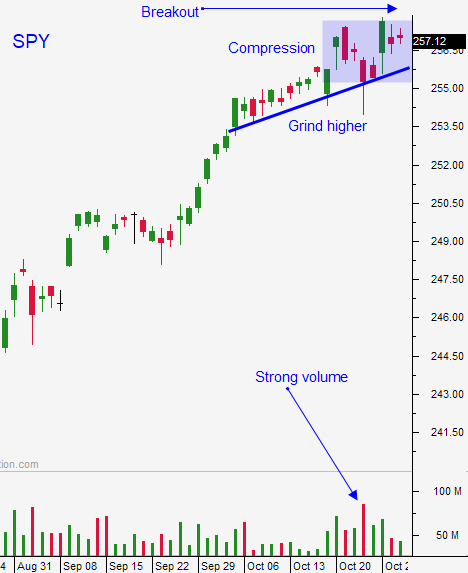

Swing traders should be long calls and they should move their stop up to SPY $257 on a closing basis. If the market can't hold last Friday's breakout you should exit. We want to see a grind higher from here. All of the positive news did not fuel a convincing breakout and that could be a sign of profit-taking. The final remaining catalyst (tax cuts) will take time to get approved and I don’t like sitting on overnight long positions when there is no movement. We need a rally right now.

The debt ceiling needs to be extended (December 8), progress on the tax cuts to be apparent, Trump needs to maintain cordial relations with China and North Korea needs to halt missile testing. These are all potential speed bumps into year-end. If the breakout does not materialize this week and I get flushed out, I feel I will have an opportunity to get back in when we hit one of these speedbumps.

My day trading strategy has been simple. I am buying futures (NASDAQ and S&P) on dips after support has been established. If the market opens higher I am not day trading.

.

.

Daily Bulletin Continues...