SPY $260 Or Bust – My Calls Are On A Tight Leash – Raise Stops

Posted 10:00 AM ET - The market has all of the ammunition it needs to move higher. We are headed for a "news vacuum" and there aren't any catalysts. The path of least resistance points upward, but the action is sluggish.

Earnings season is winding down and retailers could weigh on the market this week.

Economic releases have been strong and there are not any major numbers this week.

The Fed will hike in December. Traders are expecting this but this could be a slight headwind.

Republicans seem to be making progress on the tax cut bill. The House and Senate want to have an agreement by Thanksgiving. Any progress will be well received by the market.

Seasonal strength will keep buyers engaged and that means dips will be brief and shallow.

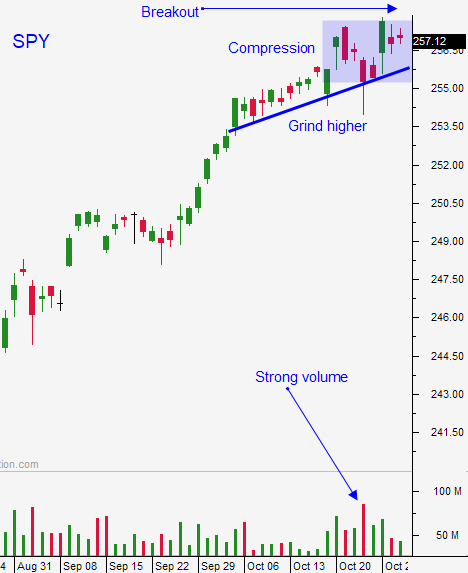

Swing traders should stay long calls. Start moving your stops higher and use SPY $257 on a closing basis. If the market stages a big one day rally, start taking some profits. We have the breakout and a little follow-through so that is keeping me in current positions.

I would not be surprised if we see a small pullback. Trump is on his Asian tour and North Korea could demonstrate their defiance by testing missiles. We could also hear tough trade talk after he meets with China.

If the market drops during the day or on the open I am buying futures once support is established. I am also day trading a few stocks after earnings releases, but my activity intraday is extremely low. I am making most of my money on swing trades.

Keep moving your stops up and take profits on any rips higher. The easy money has been made.

Daily Bulletin Continues...