Market Headwinds Are Stiff – Go To Cash and Wait For A Dip

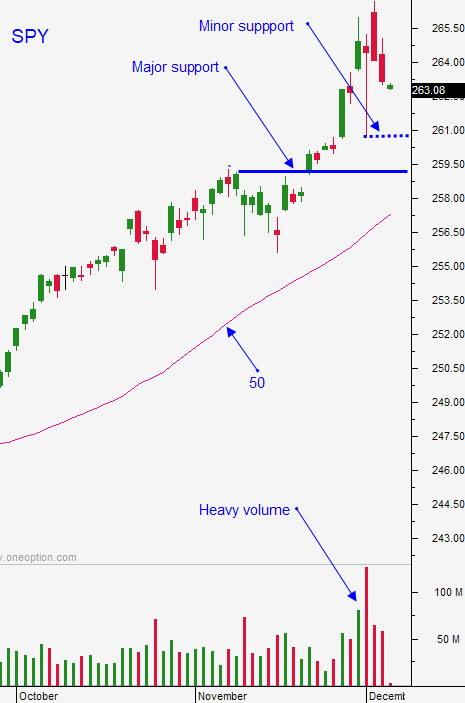

Posted 9:30 AM ET - Last week the market shot higher on the Senate's approval of a tax cut. That rally was tested and we have seen profit-taking. There are a few speed bumps for the remainder of the year and they will keep a lid on this breakout.

The Senate and the House still need to find middle ground. I believe they will and the market is pricing in a final bill that will fall somewhere between the two plans. This bill will get passed and Republicans know how important this is.

A continuing resolution was approved by Congress and the budget deadline has been pushed back two weeks. A temporary shutdown has been avoided, but this dark cloud will loom.

Next week Alabama will elect a new Senator. Republicans could lose a seat leaving them with a single vote edge. If this happens the market won't like it. Republicans have momentum and they are getting things done.

The FOMC will hike rates next Wednesday. Inflation has been tame and their rhetoric should be dovish. They don't want to spook the market when there is a change at the helm (Powell).

The budget will get another extension and it will be addressed when we hit the debt ceiling. This is when the battle begins and it will get ugly. Democrats know they have leverage and 60 votes are needed in the Senate. DACA, "the wall" and increased military spending will be added to the negotiations. This process scares me and it will scare investors. Both sides will play "chicken" and a deal will be struck until the last second.

This morning we learned that 228,000 new jobs were created in November. The market has a nice little bid this morning.

Swing traders need to remain sidelined. We will wait for a dip. As good as the rally might feel this morning, know that the rug can get pulled out at any time. There simply too many unresolved issues at this time and the upside is limited.

Day traders should be passive today. Gaps higher near the all-time high are dangerous. Most of them have reversed. If anything, I might look for opportunities on the downside the next few days. I will not carry overnight short positions.

We caught the last 60 point rally in the S&P 500 and I don't want to give any of it back. Politics are driving this market and the crosswinds are strong. The market drop we saw last Friday should serve as a reminder of how quickly things can change.

SAVE 50% ON A ONE YEAR SUBSCRIPTION TO OPTION CHAT AND SPREAD CHAT TODAY. THIS IS THE DEAL OF THE YEAR

.

.

Daily Bulletin Continues...