Speed Bumps Ahead – Wait For A Dip To This Level On SPY/QQQ

Posted 10:00 AM ET - Yesterday the S&P 500 took a breather. The market still has some speed bumps to navigate in the next week and there could be additional profit-taking. Tech stocks showed signs of life. This sector has some buying opportunities into year-end.

Politicians are likely to extend the continuing resolution for two weeks. This should have been a slam dunk, but there is some mudslinging at the final hour. They all want to go into recess so a shutdown will temporarily be avoided. Democrats will make it known that a tough battle lies ahead.

Alabama will elect a new Senator next Tuesday and Republicans could lose a seat. If this happens I believe the market will have a negative reaction. The GOP has some momentum and this would reduce them to a one-vote edge (virtual stalemate).

In January Democrats will dig their heels in. The budget needs to be approved and the debt ceiling needs to be extended. This can only happen with 60 votes and Republicans will be painted into a corner. Trump and the Democrats will play game of "chicken" that could get ugly. Democrats will try to include DACA.

The economic data has been excellent and earnings have been strong.

Tax cuts have been priced in and the market expects a final bill that is somewhere between the House and Senate versions.

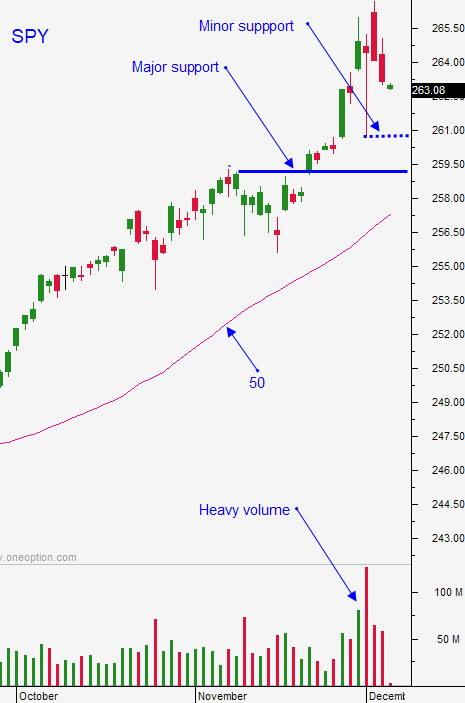

Swing traders should keep their powder dry. The FOMC next week could also spook some investors. Any pullback will be a short-term buying opportunity. I am currently looking at tech stocks. Ideally, we will hit an air pocket and a "V bottom" will provide an excellent entry point. SPY $260 and QQQ $150 would get me interested.

Day traders should look for opportunities to buy tech stocks. They are deeply oversold and many are poised to bounce. The price action in this sector was bullish yesterday.

There are a number of potential speed bumps next week. Keep your powder dry for a few more days.

.

.

Daily Bulletin Continues...