Alabama Vote and FOMC Are Important – Wait For A Dip

Posted 9:30 AM ET - Last Friday the market closed at a new all-time high. There are a couple of speed bumps this week and the action could be very subdued the next two days. The Alabama election is important and so it the Fed’s tone when they hike interest rates by .25% on Wednesday. Gains the rest of the year will be hard-fought.

Two separate polls in Alabama show Moore with a 5% lead. The Senate passed its version of the tax bill by one vote and they can't afford to lose a single seat. Republicans have some momentum and a loss in Alabama would spark profit taking. I don't feel that the victory in Alabama would spark a rally so any surprise favors the downside.

The FOMC will raise rates on Wednesday. This is widely expected and the rhetoric should be dovish. The Fed doesn't want to spook investors when there is a change at the helm. Inflation is below their target and that gives them some breathing room.

The real battle will begin in two weeks when the budget needs to be pushed back a few more weeks. The mudslinging will get nasty and Democrats will let Republicans know that they are in for a battle. The budget will get pushed back and it will be combined with the debt ceiling negotiations in January. Passage requires 60 votes in the Senate and Democrats have leverage.

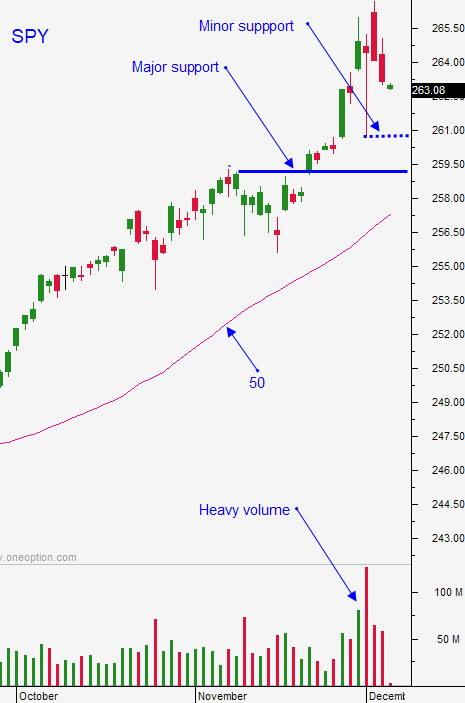

Swing traders should be sidelined waiting for a pullback. The upside reward is smaller than the downside risk at this juncture and I see many potential “land mines”.

Day traders should only be active when the market pulls back. Intraday ranges are tight and the action slows down dramatically after the initial move. Tech stocks look attractive and they have room to run.

The first half of the week should be flat and buyers will return after the FOMC. ADBE, ORCL and COST report on Thursday and many companies will provide guidance this week. The market will perform better Thursday and Friday if Republicans hold the seat in Alabama.

Error on the side of caution and stay in cash until we get a pullback.

.

.

Daily Bulletin Continues...