Stiff Market Headwind With Possible Profit Taking In January

Posted 9:30 AM ET - The market continues to float higher on year-end strength. The Alabama elections tonight will be critical for Republicans. They finally have some momentum and the Senate margin is razor thin. Polls suggest a tight race.

The budget needs to be approved on December 22nd to avoid a government shutdown. Politicians want to spend time with their families during the holiday and it will be extended into January. Before that happens Democrats will make it known that a massive battle lies ahead.

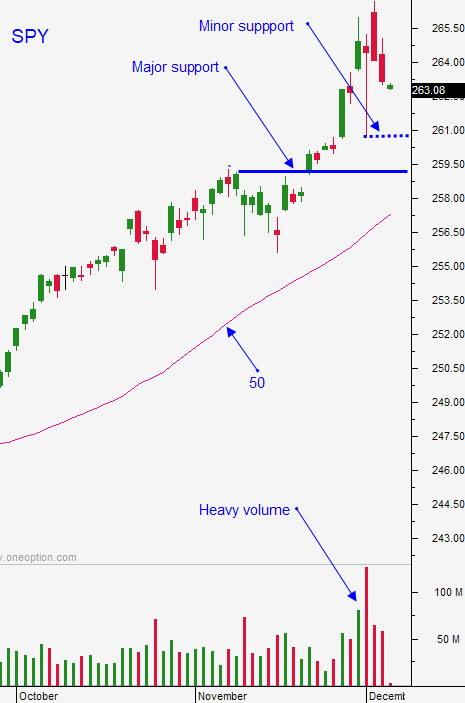

The market still has a little upside (SPY $270), but the gains will be hard-fought. In January the debt ceiling and the budget will be negotiated. Democrats know that they have leverage because 60 votes are needed. We can expect other issues (DACA, "the wall" and defense spending) to be included. That will make this a long drawn out process. It will come down to the wire and the market won't like it.

Economic releases have been strong and earnings are excellent. A quarter-point rate hike won't rattle the market tomorrow. The Fed's comments should be fairly tame. They don't want to spook the market when there is a change at the helm (Powell). Inflation is below their target and they have some breathing room. Fed officials want a nice calm market into year-end and they know that the threat of a government shutdown will weigh on investors.

Swing traders need to stay in cash. The upside is limited and any surprise favors the downside. I need to see a nice dip and I believe we will get one in January. Some investors will want to lock in profits at the all-time high and they want to do it in 2018 to postpone capital gains taxes. With the debt ceiling looming, I think we could start the year off on a soft note.

Day traders need to wait for dips. Intraday trading ranges are compressed and chasing higher opens has been a losing proposition.

If Republicans hold Alabama, I expect to see a small rally (5 pts). However, if they lose we could see a nasty little S&P 500 drop of 20+ points.

Cash is King.

.

.

Daily Bulletin Continues...