Market Doesn’t Care About Senate – It Just Wants Tax Cuts

Posted 9:30 AM ET - Last night Jones won the Alabama election and Republicans lost a Senate seat. The GOP only has a single vote advantage and it will be harder than ever to pass legislation. For the time being, the market is comfortable with the news. All it cares about is the tax cut and that will be passed before Christmas recess.

I thought we would see a bigger negative reaction than this. Mainly because stocks have rallied nicely in the last two weeks and there was room for a shakeout.

The Fed will hike interest rates today and traders will focus on the statement. I believe the tone will be dovish since officials want a nice smooth transition (Powell). Inflation is below their target so they have some breathing room.

Seasonal strength, tax cuts, economic growth and earnings are driving this rally.

Swing traders should stay sidelined until we get a nice dip. The upside is fairly limited and dark clouds loom in January. Politicians need to push the budget back into January and that process next week will reveal that a nasty battle lies ahead. Democrats will flex their muscles and they will be emboldened with an extra seat. The debt ceiling needs to be extended and 60 votes are required in the Senate.

Day traders should stay sidelined today. After the initial move, stocks will fall into a tight trading range and we will be "dead till the Fed". My day trading has been fairly limited and I am more active on down opens.

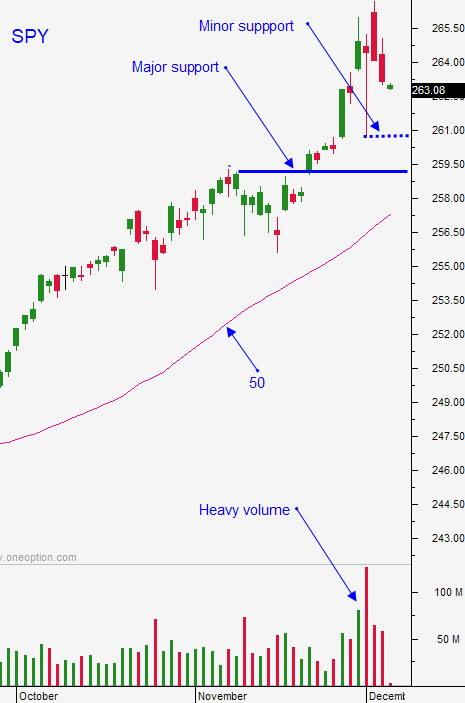

Look for a final push to SPY $270 in the next week. The debt ceiling will keep a lid on this rally.

.

.

Daily Bulletin Continues...