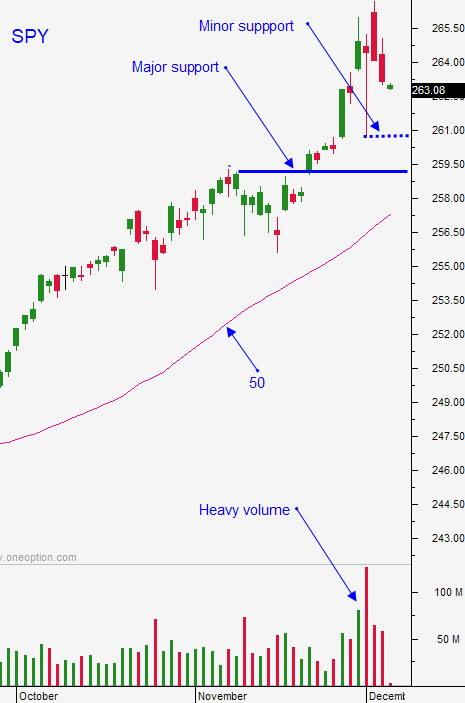

Dovish FOMC Does Not Spark Rally – Market Rally Hitting Resistance

Posted 9:30 AM ET - The market is inching its way higher and the headwinds are blowing. I believe the SPY will stall at $270. When stocks can't rally on good news a red flag is raised.

Yesterday the FOMC said that they are leaning towards three rate hikes (not four) next year. That was the dovish rhetoric I expected - the market yawned. This should have been a nice catalyst for stocks.

House and Senate Republicans have reached a tax deal. They know they will lose a Senate seat after Christmas so the pressure is on to pass legislation now. Trump desperately wants this victory. The market already knows that the final bill will fall somewhere between the two plans and it has priced in the news.

Corporate taxes will be reduced to 21%, but not for another year. This is good news, but it won't immediately drive profits.

The budget has to be approved a week from tomorrow and I feel that both parties will postpone it until January. The tax bill is the priority and there are still a number of potholes that need to be navigated. Politicians want to spend time with their families during the holidays and getting a budget approved in the next week seems unrealistic. Democrats will make it known that they have leverage and the "Battle Royale" will begin in January.

In typical fashion, politicians will get a deal done at the last second. The process will be extremely ugly and other issues will be negotiated at the same time.

After a one-year 20% rally I expect to see some profit-taking in January. Investors will wait until then to sell so that they can postpone capital gains taxes for another year. The GOP will have a hard time passing legislation with a 1 vote edge in the Senate. The upside is limited and I expect to see profit-taking. The good news is that any debt ceiling dip will present a buying opportunity.

Swing traders should stay sidelined. I am looking to sell some call credit spreads, but in small size. Stocks that have posted the biggest gains will be the most vulnerable to profit-taking.

Day traders should buy dips. If the market rallies out of the gate, keep your activity to a minimum. Trading ranges will collapse and the volume will decline next week. This is not a good day trading environment.

If you still have long exposure, take profits into strength. Don't try to milk every last tick out of this rally. I believe you will have an opportunity to reload at better levels in the next few weeks.

.

.

Daily Bulletin Continues...