Market Hitting Resistance – Stay In Cash and Wait For Dip

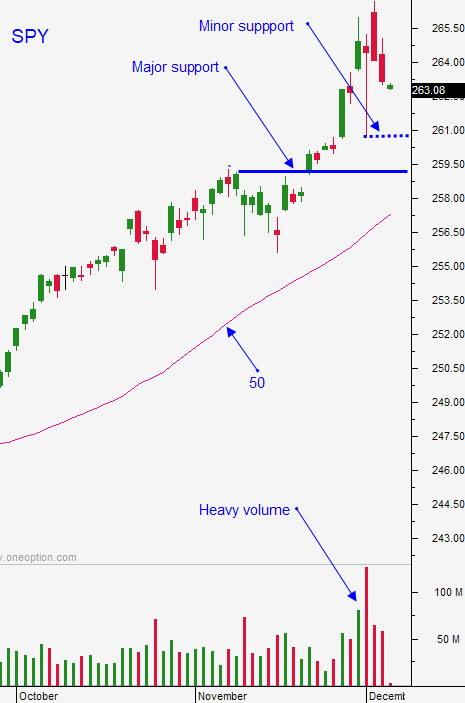

Posted 9:50 AM ET - Yesterday the market hit one of the potholes I referenced in my comments and the S&P 500 dropped. The tax bill still has to go through the process and I'm confident it will be passed. Stocks have run hard the last few months and resistance is stiff. When the market did not rally after dovish FOMC remarks, a red flag was raised.

Republicans need to convince Democrats to extend the budget into January to avoid a shutdown. This has to happen before next Friday and I believe it will. Democrats will flex their muscles and they will signal that a major battle lies ahead.

In January the budget and the debt ceiling need to be addressed. Republicans know that 60 votes are needed in the Senate and they only have 51 (if all Republicans unite). We can expect the "kitchen sink" to get thrown in to this negotiation and it will get ugly. Democrats have had a tax bill rammed down their throats and they are furious. Republicans did not like when Obamacare was rammed down their throats and they used their leverage the last time the debt ceiling had to be extended.

After a 20% S&P 500 rally in 2017 some investors will lock in profits. They want to postpone taxes into 2018 so they will wait until January to sell. I believe we could see profit-taking during a period which is typically bullish.

I'm not looking for a massive decline and I won't trade much from the short side. I'm much more interested in the bounce that follows a debt ceiling extension.

Swing traders should be sidelined. We've had an excellent year and I don't want to give profits back. The upside potential is small relative to the downside risk. Wait for a pullback in January and reload.

Day traders should buy early dips. If we don't get one, stay sidelined. If we get a pullback, wait for support and trade from the long side. Daily ranges will collapse in the next week and volumes will drop.

I have a new alert system that flags hot stocks. It conducts real-time scans for price and volume spikes. This has been keeping us busy during dull markets.

The tax bill will keep buyers engaged and the budget will keep a lid on the rally.

Cash is King.

.

.

Daily Bulletin Continues...