Swing Traders Stay In Cash – Air-Pocket Possible – Prepare To Buy This Dip

Posted 9:30 AM ET - Global interest rates are rising and investors were bracing themselves for a hawkish statement from the FOMC yesterday. The comments were fairly neutral and analysts are expecting three rate hikes this year. Economic growth has been strong and the market can shoulder higher yields. Look for nervous trading the rest of the week.

The debt ceiling and budget need to be extended and a potential shutdown looms (February 8). Democrats are flexing their muscles knowing that 60 votes in the Senate are needed. They were blamed for the last shutdown and they need to tread cautiously given that 1 million unregistered immigrants have been added to Trump's plan. It seems like politicians should be able to find middle ground, but you never know.

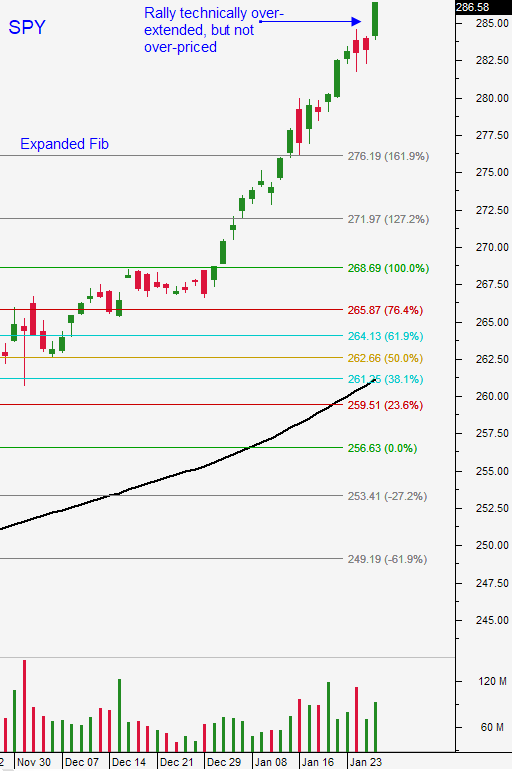

Earnings season is in high gear and mega cap tech stocks are reporting. Optimism will wane after they report. Microsoft, Alibaba and Facebook are flat or down this morning suggesting that good news is priced in. Apple, Amgen, Amazon and Google will report after the close today. Profits have been excellent and guidance is spectacular. After a huge rally stocks are technically over-extended.

The economic news has been strong and I'm expecting a big jobs number tomorrow (225K+). That could spark worries of a Fed hike in March.

Swing traders need to stay sidelined. Let the market come in and wait for support. I would like to see a dip to SPY $275. Bullish speculators need to get flushed out. A drop that lasts a few days would force them out of positions. We are seeing weakness today and Asset Managers will pull bids. I urged you to take profits last Friday and I hope you took my advice.

Day traders will have opportunities on both sides of the market. If we get an early bounce this morning watch for resistance. I feel that we could hit an air pocket. My size on the way down will be relatively small and I will be quick to take profits. We are in a very strong bull market and the bounces can be violent. I prefer to trade from the long side and I will wait for support and a compression.

Look for a wave of selling. This will ultimately set up an excellent buying opportunity. I will let you know when it's time to get back in.

.

.

Daily Bulletin Continues...