Bullish Speculators Getting Flushed Out – Good Buy Will Set Up Next Week

Posted 9:30 AM ET - The market has been nervous this week and rising global interest rates are to blame. Choppy trading is a sign of profit-taking and we can expect soft conditions for another week. Keep your powder dry and be ready to reload once support is established.

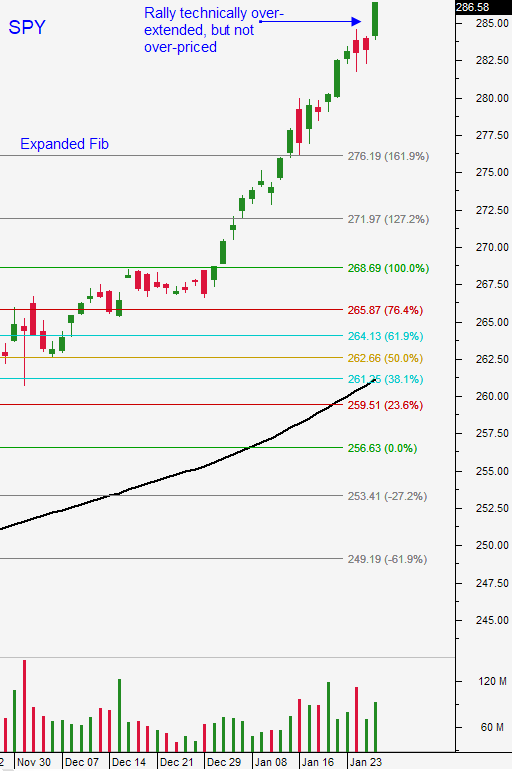

A week ago I instructed you to take profits on that blow-off rally that marked a temporary top. Bullish speculators need to get flushed out and that will require a few consecutive days of selling. We need this sustained selling and I believe support will be established around SPY $275.

The market got technically overextended and some of the "fluff" is being taken out. Mega cap tech stocks keep a bid to the market ahead of earnings and now that they have reported that excitement will wane. In general the reaction has been neutral. The results were good, but good news was priced in.

After a 200 point S&P rally in one month we should expect some retracement. The macro backdrop is very bullish. Stocks can shoulder higher interest rates as long as economic growth is intact.

The Atlanta Federal Reserve is forecasting Q1 GDP growth of 5.3%. We haven't seen growth like that in 20 years. ADP showed that 234,000 new jobs were created in the private sector during the month of January. That is a very strong number and initial jobless claims have been consistently declining. The jobs report increased 200K this morning and that is above expectations. Hourly wages increased .3% and that is a number to keep your eye on. Rising wages are great, but they mean rising inflation.

Politicians need to agree to a budget and they need to extend the debt ceiling next week. A memo from the House Investigative Committee will be released today and it could impact the negotiations. Rumor has it that it will reveal surveillance abuse by Democrats in the FBI during the election. This could put Democrats back on their heels (more receptive to a DACA deal) or it could infuriate them (government shutdown). The Democrats recently took the blame for the shutdown and they need to tread cautiously. Trump's approval ratings are on the rise and he is trying to find middle ground on DACA by adding 1 million unregistered "dreamers" to the plan. I hate commenting on politics, but it is impacting the market. The debt ceiling is a dark cloud and it will keep a lid on the market until it is resolved.

Swing traders need to keep their powder dry. There is no need to rush in until the debt ceiling is extended. A deep air pocket is possible and I will be watching for a capitulation low. If I see one I will let you know.

Day traders are back in business. Higher interest rates will keep the price action moving back and forth. Last year the intraday volatility decreased by 50% and that is reversing. I still prefer to trade from the long side and I trade larger size when I buy. On the short side I also take profits quickly. We are still in a bull market and bounces can be violent.

Let's hope that politicians can find middle ground for the good country. Once they do the market will be off to the races again.

.

.

Daily Bulletin Continues...