Don’t Trust the Bounce This AM – FOMC Likely To Be Hawkish – Be Patient

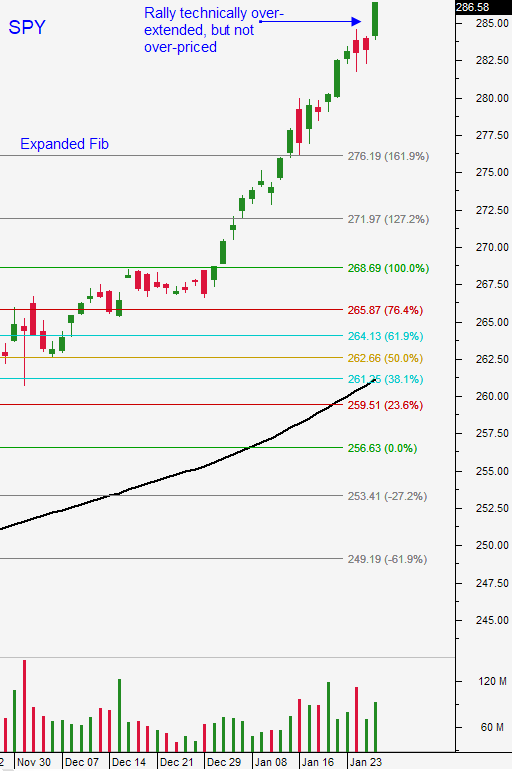

Posted 9:15 AM ET - Yesterday the market took a breather and stocks finished on the low of the day. Interest rate jitters sparked profit-taking ahead of the FOMC statement today. I believe that the Fed will be relatively hawkish. Stocks will be nervous after the release but they will settle down in a few days.

The Fed is not worried about the market after a 200 point S&P rally this month. They have breathing room and they want to get rates back to normal levels as soon as possible. Inflation is likely to start creeping into the economy. Oil prices have increased and labor costs are on the rise. Consumers have additional discretionary income from the tax cuts and that will put upward pressure on prices. I believe they could lean towards four rate hikes this year.

As long as economy is growing at a fast pace the market will shoulder higher interest rates. This morning we learned from ADP that 234,000 new jobs were created in the private sector during the month of January. That is much stronger than the 190,000 that were expected and it bodes well for Friday's Unemployment Report. Initial jobless claims have been declining the last four weeks and I mentioned that I was expecting a big number in my comments yesterday.

Earnings season is kicking into high gear. Microsoft, eBay, Facebook and PayPal will post results after the close today. Apple, Google. Alibaba and Amazon are on deck tomorrow. Profits have been excellent and guidance has been spectacular.

Trump's State of the Union address last night outlined his immigration plan. Both parties feel like they are giving too much away and that is a sign that middle ground can be reached. This is going to get wrapped into the debt ceiling extension so it's important that progress is made. Democrats know that 60 votes are needed in the Senate and they will flex their muscles. The recent government shutdown was blamed on the Democrats so they might not have as much leverage as they think.

Swing traders should be in cash. We need to let the dust settle after the FOMC statement. I still expect to see some selling this week and we should test the lows from yesterday.

Day traders should be careful on the open. I believe that the early bounce could fade and I will be looking for a shorting opportunity. The market typically compresses in a tight range ahead of the Fed so I will keep my activity relatively low after the first hour of trading. After the statement follow the momentum that is established (wait 15 minutes).

We are safely on the sidelines waiting for the FOMC reaction. Any dip this week will be a buying opportunity. Be patient.

.

.

Daily Bulletin Continues...