Market Momentum Is Strong and FOMO Is Setting In – Ride the Wave

Posted 9:00 AM ET - The market has a strong head of steam and it closed above SPY $278 yesterday. To this point buyers have been reluctant to jump in after a 12% correction and now they're getting more aggressive. Bullish speculators were burned by the market drop and FOMO (fear of missing out) is motivating them to get back in. Look for a steady grind higher this week.

The new Fed Chairman (Powell) will testify before Congress today. I expect to hear dovish comments. He is willing to let inflation tick above the 2% inflation target and that is market friendly. After a decade of under shooting that target he does not want prices to retrace and he might be willing to let inflation get as high as 2.5%. Fed officials have stated that they still plan to raise rates three times this year. That is below the four rate hike level that many analysts are projecting. US 10-year treasuries are likely to hit 3% at the end of 2018. This is a historically low level and higher yields won't impede economic growth.

The next speed bump is the wage component of the jobs report. It is 10 days away and that gives the market plenty of time to run. I plan to take profits ahead of the release.

Economic data has been strong and tomorrow we will get official PMI's from Europe and Asia. I'm expecting the numbers to be solid, but not hot.

Many retailers will post results this week and revenues should be good overall. Consumer confidence was high during the holiday season and spending was up.

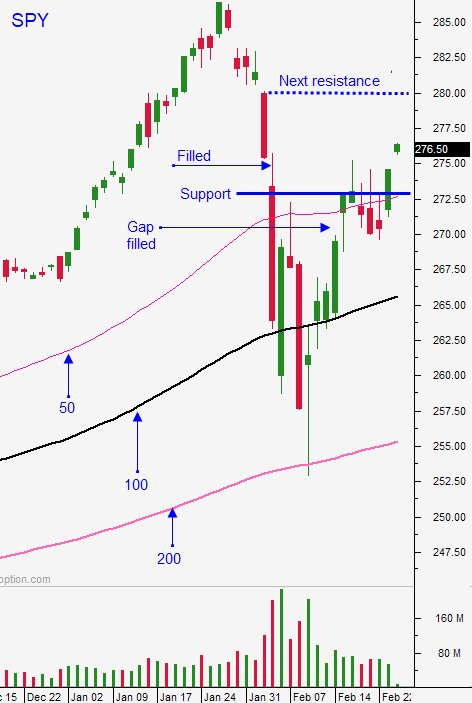

Swing traders need to stay long. Raise your stop on the SPY to $275 on a closing basis. As the market moves higher we will move the stop up.

Day traders need to wait for support. Dips will be brief and shallow and they will come early in the day. The S&P 500 is down five points before the open this morning. Disregard that move. In the last minute of trading the S&P 500 shot five points higher on Monday and we are simply giving those gains back. Trade from the long side.

I expect to see strong price action this week.

.

.

Daily Bulletin Continues...