Big Market Rally Ahead This Week – No Speed Bumps For 10 days

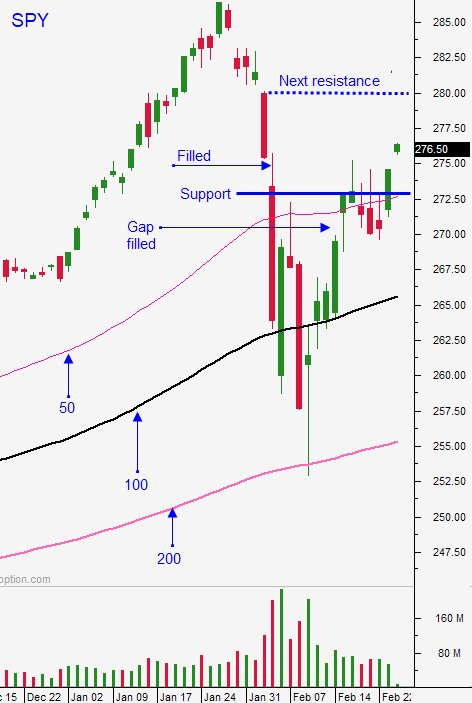

Posted 9:30 AM ET - We are going to make a lot of money this week. The market wants to rebound and last week we consolidated after a big bounce. The bid had to be confirmed and the FOMC minutes were the perfect test. After a nasty reversal Wednesday, buyers showed their appetite for stocks at the 50-day moving average. The SPY closed above my target of $274 on Friday and we are off to the races this morning.

I believe this entire drop was sparked by extreme bullish sentiment. Once "weak hands" were flushed out trading programs kicked in. They were feeding on each other and a one-week 12% correction scared the daylights out of everyone. This drop had little to do with rising interest rates and higher inflation as reported by news outlets.

The Fed confirmed that it only plans to hike three times this year. Many analysts are expecting four rate hikes so this means the Fed remains relatively dovish. Other analysts feel that the Fed is “behind the curve”. I consider this hogwash since we were the first central bank to start raising rates.

There is also talk that higher interest rates will impede economic growth. This is also nonsense. 10-year U.S. Treasury yields are expected to reach 3% by the end of the year and that is near historic lows.

Economic growth is projected to hit 5.3% this quarter. GDP has not hit that level in decades.

Corporate earnings are robust. They trimmed the fat the last 10 years and margins are very healthy. Any uptick in revenue goes straight to the bottom line. Corporate tax cuts will boost profits and S&P 500 earnings are projected to increase 17% this year.

We are in the sweet spot of the cycle and the market is going to rock this week.

Swing traders can raise their stop to SPY $270 on a closing basis. I mentioned Friday that you can add to your position if the market closes above SPY $273. That happened and you should have a "full boat". As the market grinds higher we will raise our stop. This will shock many people, but I think we could challenge the high in the next month. For now, don't concern yourself with lofty targets. Just maintain your position and don't micromanage it.

Day traders need to let the bid establish itself. We had a good run Friday and a gap higher this morning will attract some selling. Be patient and buy dips.

My target this week is SPY $278 and that should be easy to hit. The next speed bump is the wage component of the jobs report and that will not be released until March 9th. We have plenty of time to run and FOMO (fear of missing out) will fuel the rally this week.

This rally is not the same as the one we had in January. Bullish speculators have been humbled and they have not fully embraced this rebound. The same goes for many Asset Managers. They will all start to pile back in this week.

.

.

Daily Bulletin Continues...