Take Profits On the Open – Market Looks Vulnerable

Posted 9:35 AM ET - Yesterday's market decline was a warning. Take profits on long positions on the open. We need to closely monitor the price action the next few days. I am not turning bearish, but I am much less bullish than I was yesterday.

The new Fed Chairman (Powell) in his testimony before Congress suggested that four rate hikes are possible this year. That is hawkish and interest rate worries have sparked profit-taking recently. I believe that a rate hike on March 31st is likely. I thought Powell would have a more dovish tone given his statements about inflation. He previously said that he does not want to overreact to a 2% rise in prices when it has taken us years to hit that target.

Interest rates are still near historic lows and higher yields will not impede economic growth. However, at the beginning stages of an economic cycle the reaction to higher interest rates is negative. As economic growth presents itself the market gets comfortable with higher yields and it moves higher. We need to wait for that transition.

That leads me to the next development. China's PMI came in at 50.3 and that was well below the 51.4 level that was expected. China is the global growth engine and this number will weigh on the market.

From a technical perspective I did not like the bearish engulfing pattern yesterday. That reversal will spark more selling today and the bid will be tested. This is a time to evaluate the price action from the sidelines.

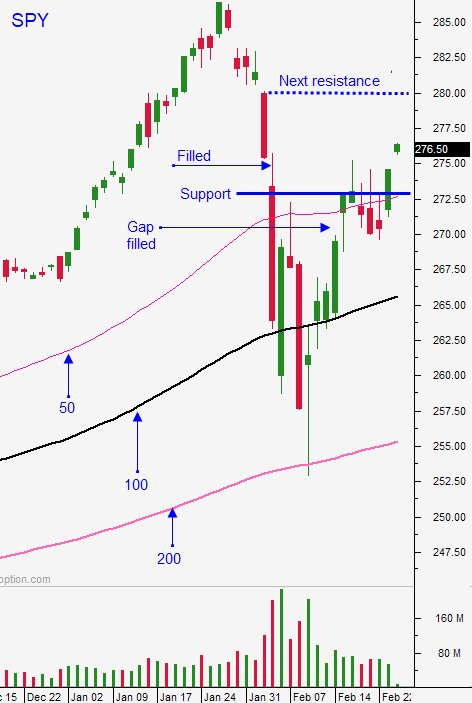

Swing traders need to take profits on the open. We bought the SPY at the 200-day moving average two weeks ago at $253.50 and we are up 9% since then. It would be foolish not to take a gain like that. As I mentioned in my comments I am not bearish - I am less bullish and I believe that we could see volatile trading until the dust settles. Being on the sidelines keeps our risk low and we are able to evaluate market conditions. I know that the wage component of the unemployment report a week from Friday could be problematic.

Day traders should look for an opportunity to get short today. Let the early bounce run its course and look for weakness. Basic material stocks will pullback after China's weak PMI. Use the first hour range as your guide. If we are below it, favor the short side. If we are above it, favor the long side.

Resistance is at SPY $278 and support is at $270.

.

.

Daily Bulletin Continues...