Most Traders Will Make This Mistake Today – Don’t Be One of Them

Posted 9:40 AM ET - Yesterday I advised you to exit long positions on the open and that was good advice. As suspected, the opening rally did not hold and the market reversed. Stocks closed on the low today and the S&P 500 is down five points before the open. Conditions have changed and the bottoming process is going to take time.

Fed Chairman Powell said that four rate hikes are possible in 2018 when he testified before Congress Tuesday. That hawkish tone sparked profit-taking. The FOMC meets on March 31st and there is a good chance that interest rates will be raised. On a longer-term basis the market will accept higher rates as long as they are accompanied by strong economic growth and moderate inflation.

Economic data points were soft yesterday. China's PMI was weaker than expected and durable goods orders declined .3%. We need strong economic growth during a rising interest rate environment.

Inflation is on the rise and it has reached the Fed's 2% target. A week from tomorrow the Unemployment Report will reveal wage increases. This is the largest input cost for companies and it is the primary driver for inflation. Expenses increase and companies raise prices. Higher wages also mean that consumers have more discretionary income. The wage component of the Unemployment Report sparked the 12% correction. This morning the PCE deflator came in at .4% (expected) and market liked the number.

Corporate earnings have been robust and guidance is strong. This part of the equation is still intact and profits are expected to grow 17% this year. At a forward P/E of 16.5 valuations are at the upper end of the range and there is room for a retracement. We are not in bubble territory by any means.

Swing traders need to patiently wait in cash. We bought at the 200-day moving average three weeks ago and we made about 230 S&P 500 points by selling on the open. We need to let the dust settle for a few days. I don't believe stocks will have a meaningful rally until the wage component of the jobs report is known. Even after that the FOMC meeting (3/31) will cast a dark cloud over the market. We will be waiting for our next opportunity to set up.

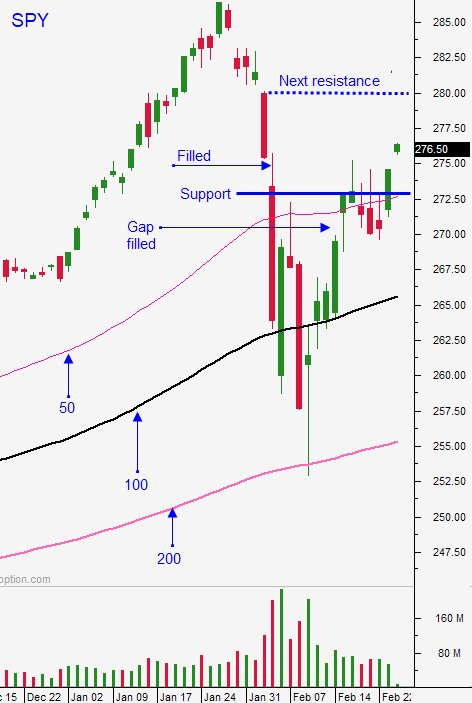

Day traders need to use the first hour range as a guide. I mentioned this in my comments yesterday and you did well if you traded from the short side. If the market is below the first hour low, favor the short side. If the market is above the first hour high, favor the long side. Support is at SPY $270 and that will be tested this morning. The next support level is SPY $266 (100-day MA). Resistance is at $272.40 and $276.60.

Look for choppy trading the rest of the week. If we are below the first support level we will drift lower. If we are above the first resistance level we will float higher. Once the momentum is established the market continues in that direction.

Most traders want to have positions on all the time and they end up pissing their capital away in a low probability environment. Don’t be one of them. Keep it small or better yet – don’t trade until the dust settles. The market could go either way.

.

.

Daily Bulletin Continues...