Nasty Market Decline Today – SPY Did Not Trade Above 50-Day MA – Stay In Cash

Posted 9:30 AM ET - Yesterday the FOMC released its statement and it was more hawkish than I expected. The new Fed chairman is not too concerned about market reaction and I find that refreshing. This year's forecast remains the same (two rate hikes) but the Fed could be more aggressive in 2019. The S&P 500 is down 30 points this morning before the open.

In the FOMC statement the Fed said that inflation will ease back to the 2% target in the next few months. That is dovish and it gives the Fed some breathing room. However, they see very strong economic growth on the horizon and they feel that the "safety net" from the 2008 financial crisis is no longer needed. They want to normalize interest rates. Yields are still near historic lows and there is plenty of room for them to move higher without impeding economic growth.

Trump will announce his tariff plan today. That has investors on edge and many believe that a trade war with China will result. There is a provision for tariffs on technology from China. Trump is punishing them for patent theft/infringement. China could retaliate with higher tariffs on agricultural imports from the US. I hope we see the plan today. As I mentioned last week, China had an average tariff of 17% on US goods sold in their country. Pressure from Trump forced them to cut that in half in November.

The debt ceiling needs to be extended and that could also be weighing on the market. From what I've read there should be enough votes. Both parties want to avoid a shutdown ahead of mid-term elections and Democrats don't want to spoil their momentum with another "Schumer shutdown".

Earnings season will begin in a few weeks and that will keep a bid to the market.

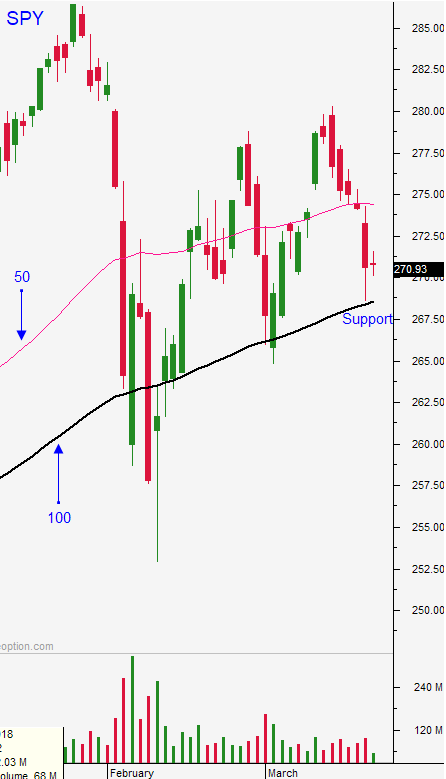

Swing traders need to stay sidelined. The SPY did not rally above the 50-day MA yesterday and we are going to let this wave of selling play out. The 100-day MA will be tested this morning (SPY $268.73). Buyers have been interested at that level and I want to see support before I buy this dip. I WILL NOT BUY TODAY. If the market closes below that level I won't buy until it closes above the 100-day MA. The 200-day MA is at SPY $260 and I'm much more interested in that level. The market did not rally after the FOMC statement as I expected and I need to respect this move.

Day traders need to be careful early. I would try to short any rally up to the 100-day MA and I would use it as a stop. This would be the tactic early in the day. For the remainder of the day I would use the 100-day moving average as a guide. If we are above it favor the long side and if we are below it favor the short side. This drop before the open feels like we could be in for a nasty day.

If the market closes below the 100-day moving average for a few days the entire character of the market will have changed and my bias will turn from long-term bullish to neutral.

.

.

Daily Bulletin Continues...