FOMC Statement Will Be Dovish – Here’s How To Trade It

Posted 9:30 AM ET - The market has pulled back recently and investors are nervous ahead of the Fed's decision today. Everyone is expecting a rate hike and the statement will be scrutinized. I believe Fed officials will lean towards two more rate hikes this year and that would be market friendly.

Inflation (price and wage) is contained and that gives the Fed some breathing room. After a rate hike the tone is typically dovish. Powell does not want to disrupt the market early in his tenure so he will error on the side of caution.

The debt ceiling will get extended Friday. It does not include a provision for "the wall" or DACA. Neither party will benefit from a government shutdown ahead of mid-term elections. Democrats have won some local elections and they have momentum. They do not want to spoil that with another "Schumer shutdown".

Earnings season will begin in two weeks. Buyers are engaged ahead of the announcements and the bid will strengthen. Guidance has been fantastic.

Economic releases have been strong.

Interest rates are still low by historic measures and we have lots of room for yields to move higher before they impede economic growth.

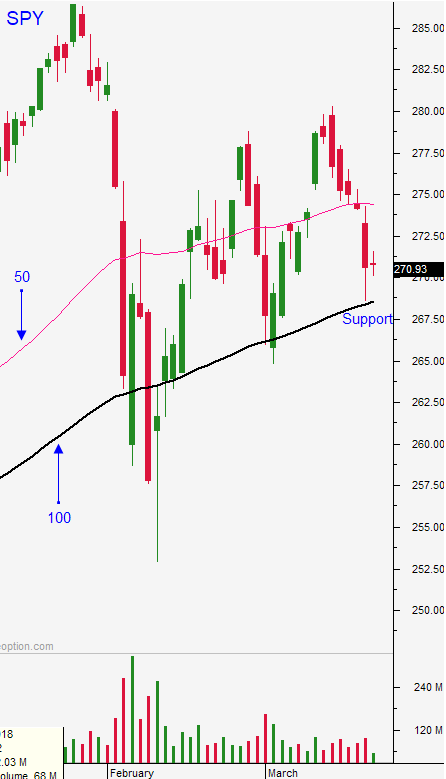

The market got ahead of itself and some of the "fluff" was taken out during the last week and a half. We are going to see a relief rally in the next few days and the next leg higher will begin.

Swing traders should buy calls if the market trades above the 50-day MA or below the 100-day MA at any time.

Day traders should be on the sidelines for most of the day. We will see some choppy trading early and the range will collapse ahead of the Fed. After the release I like to wait 15 minutes before joining the momentum.

The selling we've seen in the last couple of weeks will end and the market rally will resume.

.

.

Daily Bulletin Continues...