Buy Stocks Today If You See This – Last Time the S&P 500 Rallied 200 Points

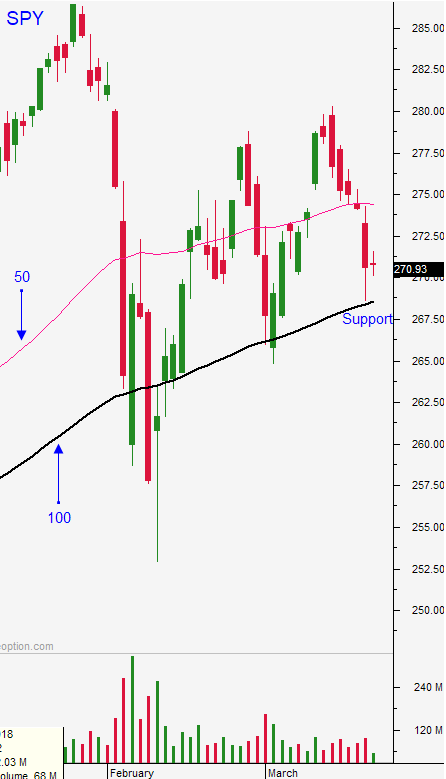

Posted 9:30 AM ET - The market blew right through the 100-day moving average and the low from February is in striking distance. After a heavy round of selling the 200-day moving average will be tested. There's a good chance it could happen today and it could culminate with a capitulation low. The last time this happened (February 9th) was also on a Friday.

In order for this pattern to set up we need to hit another air pocket. The SPY needs to find instant support at the 200-day moving average and it needs to fly off of that level and retrace the rest of the day. We will need at least an hour for the market to zoom off of that level. If it happens, we will see massive follow-through buying Monday and Tuesday.

The debt ceiling will be extended. Democrats feel like they negotiated well. They have momentum after winning local elections and they don't want to spoil the momentum ahead of mid-terms. The extension might happen after the market closes today and there will be a relief rally Monday.

Trump’s tariffs will not take effect for two months and there is time to negotiate. He is sending a message to other countries that impose hefty tariffs on US goods. Without this threat he has no leverage. I believe that calm minds will prevail and that trade agreements will be renegotiated.

The Fed plans to raise rates two more times this year (dovish). They feel that inflation will subside in coming months and that will give them some breathing room. The FOMC statement was hawkish with respect to tightening in 2019. That is a long way off and the tone can change if economic growth stumbles.

Earnings season attracts buyers and Q1 will start in a few weeks. Guidance has been fantastic and profits are expected to grow 17% this year. At a forward P/E of 16.5 valuations are little stretched, but not unreasonable.

The character of the market has changed and we have violated major moving averages with ease. My longer-term bias has shifted to neutral for the first time in years.

Swing traders need to stay in cash. Watch for the drop today. If the SPY trades below the 200-day moving average ($258.16) we will buy when it crosses back above $260. Both conditions need to be met. We need to let the capitulation low form and we want to buy once the bounce is underway.

Day traders should look for an early opportunity to short the market. The downside will be tested. If the capitulation forms, get long late in the day and consider holding overnight.

If you have to eat a frog… do it fast. We want this wave of selling to run its course quickly. This market drop will present an excellent buying opportunity.

.

.

Daily Bulletin Continues...