Earnings Rally Will Last 3 Weeks – China Backs Down

Posted 9:30 AM ET - Yesterday the market bounced and it had a nice head of steam by mid-day. White House comments over the weekend soothed trade war concerns and stocks rallied ahead of earnings season. Those gains vaporized when we learned that the FBI raided the offices of Trump's lawyer (Cohen). The market is completely news driven and this morning the wind has shifted again. It is at our back and the futures are up 30 points before the open.

China's President Xi promised to open the country's economy further and he will lower import tariffs on products including cars. These pledges were reiterations of previously announced reforms so there is nothing new. It does demonstrate a willingness to keep the rhetoric friendly.

As I've mentioned in recent comments, China is negotiating from a position of weakness. Countries with massive trade surpluses have the most to lose. Their shadow banking industry is in peril and their real estate bubble could pop any time.

Earnings season is about to kick off. Profits are expected to rise more than 18% in Q1 and that will calm nerves. Buyers are engaged and I'm expecting a few weeks of positive price action.

Swing traders should be long XLF. Higher interest rates and full employment is good for the banking sector. Chase, Wells Fargo, Citigroup and PNC will post results Friday. Use the 200-day moving average on the XLF as your stop on a closing basis.

Day traders should look for an opportunity to get long early in the day. The news was good and I'm expecting a grind higher.

Know that my longer-term market bias has shifted to neutral. We've seen heavy selling in the last two months and investors are nervous. I am looking for a bounce that lasts a few weeks, not a run-away rally.

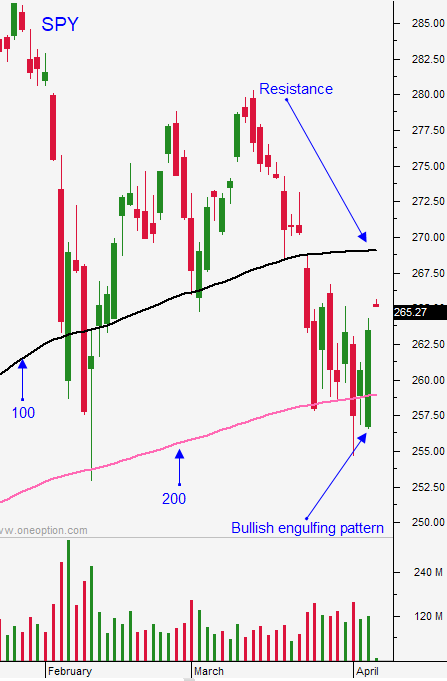

Support is at SPY $259 and resistance is at $267

.

.

Daily Bulletin Continues...