Air Strikes In Syria Not A Concern – Market Will Recover Quickly Today

Posted 9:50 AM ET - Yesterday stocks rallied, but the action was very tenuous. Without question there are buyers and sellers. On every rip we would see a quick retreat and on every dip we would see support. The futures are down overnight on concerns that the US will get more involved in Syria. I will be buying on support today.

The market has been able to fend off the threat of a trade war and heated rhetoric between China and the US. That tone has been much more conciliatory. A possible trade war is a much bigger market threat than airstrikes in Syria and I see this dip as a buying opportunity.

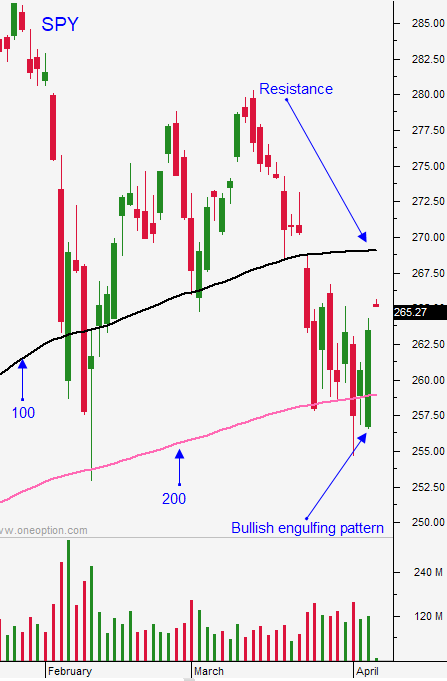

The S&P 500 is compressing above its 200-day moving average. Profits will calm nerves and they are expected to rise 18% this quarter. Major banks will post earnings Friday.

Economic data has been strong and inflation is moderate.

Swing traders should be long XLF. Use the 200-day moving average as your stop. Buy XLE on the open today. Energy stocks are starting to catch a bid and oil is moving higher. Use the 200-day moving average as a stop on a closing basis. I am favoring ETFs because these companies will be reporting earnings and I don’t hold individual stocks over the number.

Day traders should let the market come in. Look for support in the first hour of trading and look for opportunities to get long. I like the energy sector and I like financials.

The overnight news is that that dire. This is a nice little buying opportunity ahead of earning season. I am just looking for a market bounce during the next few weeks. Keep your size relatively small and know that there will be volatility.

.

.

Daily Bulletin Continues...