A Tweet-Free Week Would Spark A Rally – Profits Will Calm Nerves

Posted 9:30 AM ET - A possible trade war between China and the United States is weighing on the market. Tensions eased over the weekend and we are seeing a 13 point bounce in the S&P 500 before the open. I would not trust this early rally. We've seen many of these fail in recent weeks. The bid is starting to grow as earning season kicks off in a few days. If the trade war rhetoric is subdued, the market will try to grind higher this week.

Banks will report Friday (Chace, Wells Fargo, Citigroup and PNC). The results should be good. Interest rates are rising and unemployment is falling. This is the perfect backdrop for banks and the reaction should be positive. Tech stocks won't provide the normal boost since social media privacy concerns are weighing on Facebook and Google. Nothing calms market nerves like profits.

The Fed said that inflation is going to moderate. The wage component of the Unemployment Report was a little hot (.3%) in March. Moderate inflation will give the Fed some breathing room and they only plan to hike two more times this year. This dovish stance is market friendly.

The jobs report last week was light (103,000), but I pay closer attention to ADP. They process payrolls and they reported that 241,000 jobs were created in the private sector during the month of March. That is a very strong number. ISM manufacturing and ISM services also came in strong.

Last week I mentioned that China is negotiating from a point of weakness. Countries that run huge trade surpluses are at greatest risk during a trade war. Their shadow banking industry is heavily invested in real estate and there are serious cracks in the dam. We need to watch credit conditions very closely if trade negotiations deteriorate. Food prices will spike instantly if they place tariffs on US agricultural products and Chinese consumers will immediately feel the pain. China recently lowered its tariffs after Trump's visit in November. They are willing to negotiate and I believe a deal will be reached before August. That is when the new tariffs will be implemented.

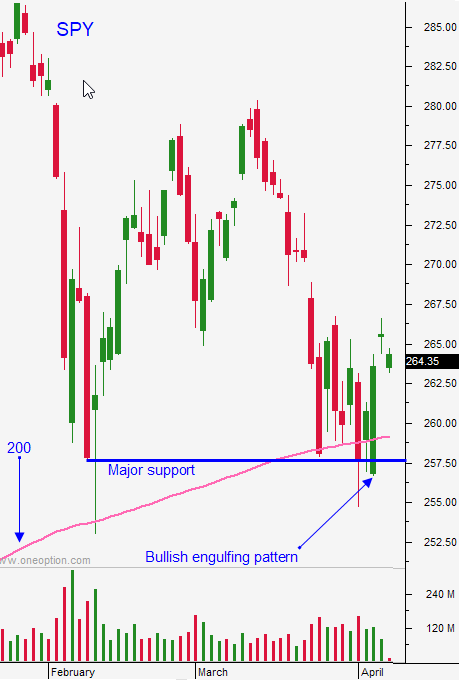

Swing traders are long the XLF. I believe that this sector will perform well into earnings season. Use the 200-day moving average as a stop on a closing basis. Trade negotiations need to take place behind closed doors. No news on this front will give the market a little breathing room and we should see a relief rally as companies report robust profits. Any caustic tweets will spark selling. The S&P 500 is finding support at the 200-day moving average.

Day traders should look for an early opportunity to short this bounce. We've seen steady selling pressure in the last two months and nothing has changed materially over the weekend. Buyers will not be aggressive until support is established. After the initial probe for support, use the first hour high in the first hour low as your guide. If we are above the first hour high favor the long side. If we are below the first hour low, favor the short side. Support is at the 200-day moving average ($259) and resistance is at $268.

The market will bounce this week if we don't get any tariff tweets.

.

.

Daily Bulletin Continues...