Profit Growth of 18% Will Attract Buyers – Buy These 2 ETFs

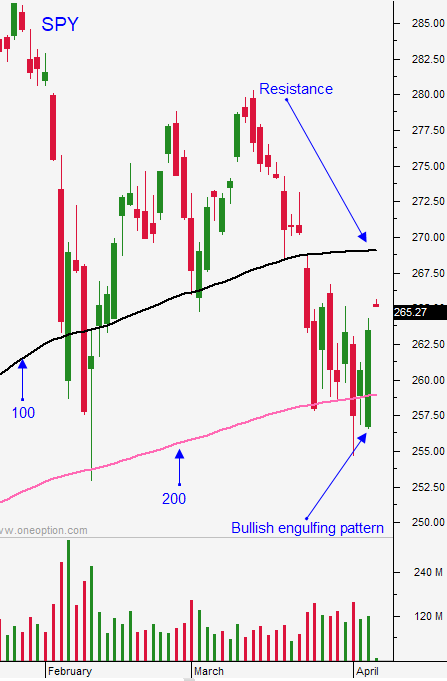

Posted 9:30 AM ET - The market is compressing above the 200-day moving average and it has been able to shoulder negative news. The US and China were exchanging tariff threats a week ago and support held. News of Syrian airstrikes did not rattle investors yesterday. The bid is growing ahead of earnings season and it kicks off tomorrow with Chase, Wells Fargo, Citigroup and PNC. The backdrop for banks is good and the financial sector should bounce. That will provide a springboard for the rest of the market.

S&P 500 earnings are expected to grow 18% this quarter. We haven't seen results like that in years. Nothing calms market jitters like profits and stocks will start to grow into their valuations.

Economic releases have been excellent. Growth is strong and inflation is moderate.

The Fed will hike rates two more times this year and that is dovish.

I am expecting an earnings bounce and it should last through the month. The SPY should be able to get above its 100-day moving average. The recent selling pressure has been heavy so the gains will be hard-fought.

Swing traders should be long XLF and XLE. These two ETF's should perform well relative to the market. The backdrop is strong for both sectors and you should use the respective 200-day moving averages as your stop on a closing basis.

Day traders should look for opportunities to get long early this morning. Favor the long side especially if the market is trading above its first hour high.

Buyers will focus on profits and we should see a nice bounce that lasts a few weeks.

.

.

Daily Bulletin Continues...