Here’s Why the North Korean Summit Will Determine Market Direction

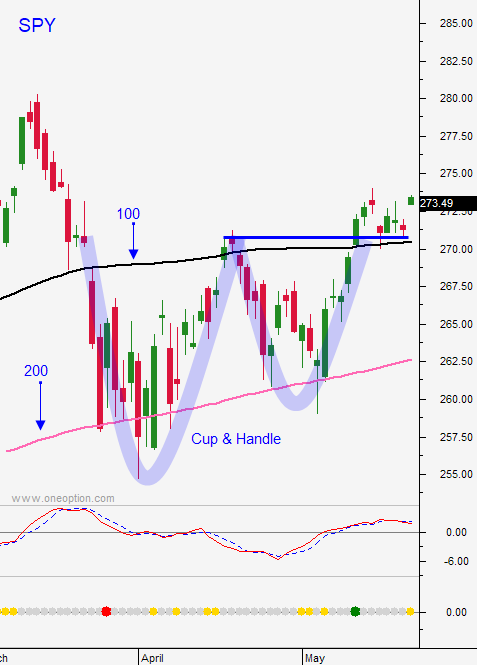

Posted 9:30 AM ET - Yesterday the market surged higher after the US and China jointly announced a trade negotiation truce. Both sides stated that progress is being made and they need time to lay the framework. A possible trade war between the world’s largest economies is the largest market threat. The relief rally pushed the SPY to a minor resistance level at $274. The rhetoric should remain "friendly" until the North Korean summit on June 12th. Look for a gradual drift higher on light volume ahead of a holiday.

Flash PMI's will be released Wednesday followed by the FOMC minutes later in the day. These are the two major economic events and I'm not expecting any surprises. Economic activity should be solid and the Fed's comments should be relatively dovish (two more rate hikes this year and moderate inflation).

The market rally Monday did not have any "legs". Stocks closed where they opened. There were no details on the trade negotiations with China. Until recently both sides were far apart. This joint announcement could have been a way for both countries to save face. Trump wants to see how the North Korean summit goes. He does not want to be embarrassed and China has a critical role. Sanctions against North Korea mean nothing unless China participates. If the summit goes well I believe Trump will be willing to make trade concessions. If the summit with North Korea goes poorly Trump will play "hardball" with China.

NAFTA will not happen until Mexico has its election on July 1st. The leading candidate has a 15 point edge and he is likely to nationalize the energy industry. Trade negotiations could be strained.

The EU is fragmented and each country has its own interests. Sanctions against Iran will complicate matters.

I believe that everything hinges on a successful summit with North Korea. If North Korea agrees to de-nuke a trade deal with China will happen quickly. That first domino would put pressure on the other countries to find middle ground and to get a trade deal done. If the summit goes poorly the US/Chinese trade negotiations will be strained. The EU and Mexico/Canada will feel that the US can’t have a trade war with the world and they will be less likely to negotiate.

The rally yesterday was nice, but the gains can easily be stripped away.

Apart from trade negotiations and the North Korean summit, the macro backdrop is bullish. Earnings are excellent, interest rates are low, valuations are in line and inflation is moderate.

Swing traders are still on the sidelines. The SPY did not make a new high for the day after two hours of trading. We will try a similar tactic today. If the SPY is trading above $274 after two hours of trading, get long. Use SPY $272 as a stop on an intraday basis.

Day traders should expect early movement and a compressed range the rest of the day. The news is light this week and traders will wait for flash PMI's and the FOMC minutes tomorrow. Use the first hour range as your guide. If the SPY is above $274 you can get a little more aggressive with longs.

.

.

Daily Bulletin Continues...