Trade Truce Between US and China – Buy Calls If This Condition Is Met Today

Posted 9:30 AM ET - Over the weekend we learned that trade negotiations between China and the US are progressing. Tariffs have been postponed while the framework of a trade deal is being drafted. The US has a verbal commitment from China that they will increase US imports. This is the darkest cloud that hangs over the market and the S&P 500 is up 15 points before the open.

China is the second largest economy in the world and a trade dispute is the primary threat to this market rally. Energy, agriculture and aerospace will be the largest benefactors of a trade deal. The temporary truce will keep North Korea at the negotiating table. Both countries could benefit from opening trade in that country.

European trade negotiations will be much more difficult. Each country has its own interests and companies doing business with Iran will be sanctioned. Mexico will hold elections on July 1 and a NAFTA agreement won't happen before then.

Global economic conditions are strong. Interest rates are low by historical standards and central banks are not raising rates. Inflation is not a concern and the Fed has breathing room.

Earnings have been excellent and guidance is strong. Forward P/E's are at the upper end of the range and stocks will grow into current valuations by year-end.

Trade negotiations with China are critical. Once a trade deal is finalized the other dominoes (EU and Mexico) will fall. Nothing has been finalized so any follow-through rally will be tenuous.

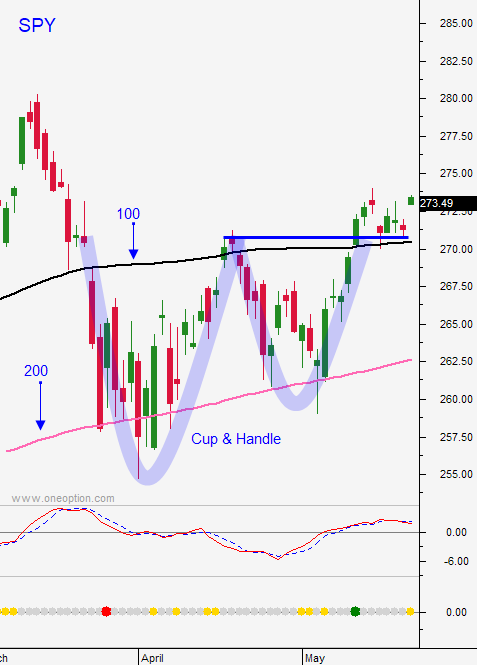

Opening gaps higher have been very dangerous. If selling pressure pushes the market below Friday's close we could see more selling. We need to make sure that this rally holds. Swing traders can buy the SPY if it makes a new high for the day after two hours of trading. Use SPY $272 as a stop on an intraday basis.

Day traders should be cautious in the first hour of trading. If the market is able to grind higher, join the momentum. If the market reverses and it is trading below Friday's close, favor the short side.

We don't have any details from the negotiation so I am skeptical. China and the US could be miles apart and this is a way to keep the conversation going without disrupting global markets. Trump realizes that denuclearization of the Korean Peninsula is the current priority. For the first time in decades this might be possible and we need China’s help.

If the early rally holds, get long and use intraday stops.

.

.

Daily Bulletin Continues...