Buy Puts On the Open – Trade Negotiations Stall and NK Getting Cold Feet

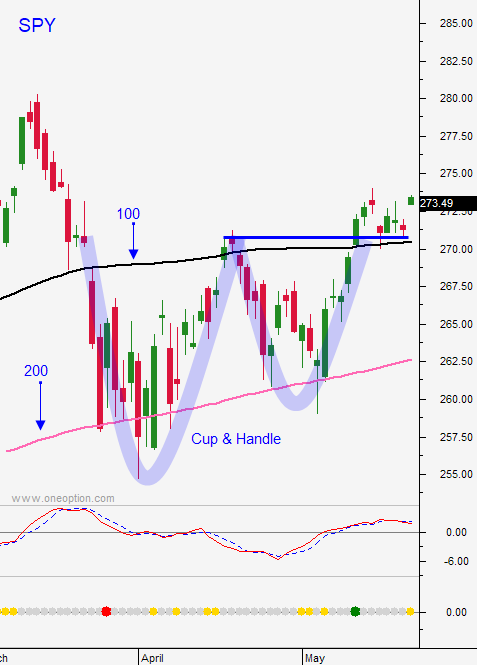

Posted 9:30 AM ET - I have been skeptical of the rally this week. Trade talks between China and the US came to a standstill and both sides declared a temporary truce. North Korea is getting "cold feet" and the tone is starting to sour. Investors will error on the side of safety and the S&P 500 is likely to close below the 100-day moving average today. I am taking a short position.

The US and China could have stated that they are miles apart and that they can't find middle ground. Instead, they said that progress is being made and that they need time to draft a framework. Trade negotiations will be lengthy. The longer it takes… the better for China. They can continue to "milk" the current agreement. China reduced US auto tariffs (25% down to 15%) as a sign of good faith. Months ago the US halted chip sales to Chinese cell phone maker ZTE after they got caught violating trade sanctions against Iran and North Korea. The company is on the brink of failure. Trump is considering some concessions on ZTE but the opposition in Congress is heavy. Mnuchin stated that steel and aluminum tariffs will remain. In aggregate, this does not look like progress to me.

As I stated in my comments yesterday I believe that North Korea is the key to a US/China trade deal. The summit on June 12th is critical and there is a rumor it could be postponed.

Trade deals in Mexico and the EU will be strained for the reasons I've outlined earlier in the week. Aluminum and steel tariffs will go into effect June 1st if a new EU agreement is not reached.

Political winds are also blowing in Italy and Turkey (credit risk).

Economic conditions have been strong, but flash PMI's in Europe and Japan were soft today.

The FOMC minutes will be released this after noon. The Fed comments should be consistent with two more rate hikes this year.

Swing traders are in cash since the SPY did not trade above $274 after the first two hours of trading yesterday. This morning you should short the DIA on the open. Use the 100-day moving average ($248.42) as your stop on a closing basis.

Day traders should look for opportunities to get short right on the open. I'm expecting the SPY 100-day MA to fail right away. Use the 100 day moving average ($270.25) as your guide.

There are many market uncertainties and we should see selling pressure today as Asset Managers reduce risk.

.

.

Daily Bulletin Continues...