We Are Back In Cash – I Will Buy VIX Today and Day Trade From the Short Side

Posted 9:30 AM ET - Yesterday the market took a breather after breaking through horizontal resistance earlier in the week. Tech stocks saw some profit-taking after the NASDAQ 100 made a new all-time high and that selling pressure will continue today. Apple has asked iPhone component suppliers to reduce production by 20% and the stock is down 1% before the open.

The North Korean summit will take place at 9:00 PM ET Monday. It will set the market tone for the rest of the summer.

As I've been mentioning in my comments this week I believe that the summit will be pivotal to trade negotiations with China. China controls the talks and they would like a long drawn-out process. As long as China keeps Kim Jong-Un at the negotiating table they have leverage over both countries. I believe the summit will be cordial and fruitless. South Korea, China and Japan are licking their chops over possible business opportunities and it will be difficult for Trump to drive a hard bargain.

Trump is spread thin. He is in Canada at the G7 meeting where allies are likely to give him a tongue lashing over recent steel/aluminum tariffs.

Economic conditions and corporate profits are robust. Traders have been focused on fundamentals and they have ignored the political headwinds.

We also have an FOMC statement next Wednesday and the Fed is likely to raise rates.

Swing traders are in cash. Yesterday we were stopped out of our QQQ calls for a small loss when the index traded below $174. We will stay sidelined until the events play out next week. The summit will take place at 9:00 PM Eastern time Monday evening and we will see an initial reaction Tuesday morning.

Day traders should favor the short side today. I believe investors will reduce risk after a nice run. Major events will impact the market next week and uncertainty is elevated.

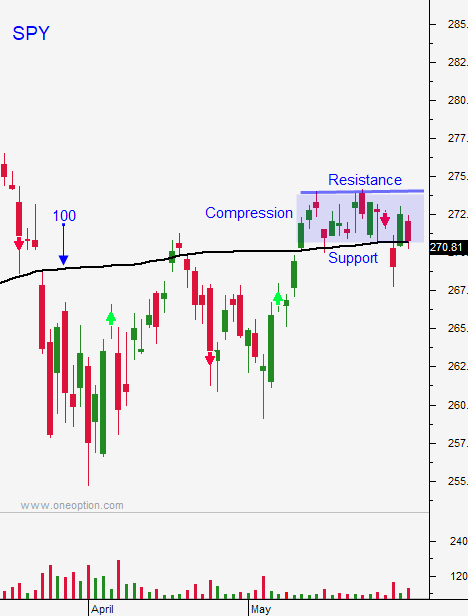

Support is at SPY $274 snd $170.90 on the QQQ.

.

.

Daily Bulletin Continues...