Russian Unites Washington DC

Posted 9:30 AM ET - During an 18-month long Russian collusion investigation I could not resist the headline. Of course the Russian I am speaking of is Alexander Ovechkin. He was voted the MVP in the Stanley Cup playoffs and he helped fuel the Washington Capitols to a championship. We finally have something Democrats and Republicans can agree on.

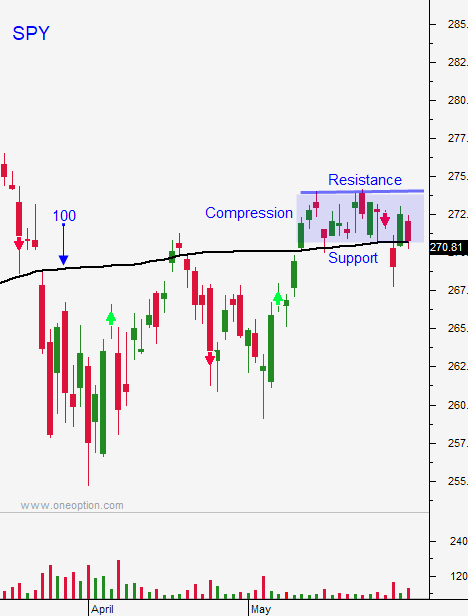

The market has broken through major resistance levels in the last two weeks and the gains are holding. The focus has shifted to fundamentals and tariffs with our G6 allies have not deterred buyers. Tonight (9 PM Eastern time) president Trump will meet with Kim Jong-Un and traders will wait for the news.

I believe the meeting will be cordial and fruitless. After decades without dialogue, Trump will be reluctant to walk away. While negotiations continue, North Korea will build its nuclear arsenal. As long as Kim Jong-Un is "at the table", China will have leverage in US trade negotiations.

North Korea has been known to stall and it is at a juncture where nuclear testing is not necessary. It's hard to imagine the 180° shift in the last six months when they have spent decades building their program. China and Russia have been cheating on sanctions and this is taking some of the pressure off. Both countries are engaged in the process.

Trump is fully aware of the situation. If he senses that this is a stall tactic he might walk away. Trade negotiations with China will break down if this happens. The US took heat during the G7 meeting and a trade war with the world could result. I don't believe this will escalate immediately, but it will unfold this summer.

China and Russia love it when the US is distracted. North Korea serves a purpose.

I hope for the sake of the people in North Korea that I'm wrong.

The FOMC will meet Wednesday and rates will go up a quarter-point. Powell will hold a press conference afterwards and traders will be looking for any hint of accelerated tightening in 2019. This news could spark a little selling, but the market will be able to shoulder it. Economic growth is strong and inflation is moderate.

Swing traders should remain sidelined. Let this news unfold. When we have clarity we will take a position.

Day traders should look for a quiet session. I believe the political winds will be calm after the summit. Trump will need time to reflect on the conversations. The FOMC could spark some nervous jitters.

The market wants to move higher, but major events will keep a lid on the rally for the next few days.

I'm going to keep my trading to a minimum the next three days. Use the first hour range as your guide.

.

.

Daily Bulletin Continues...