Ride Your Call Positions As Long As QQQ Is Above This Level

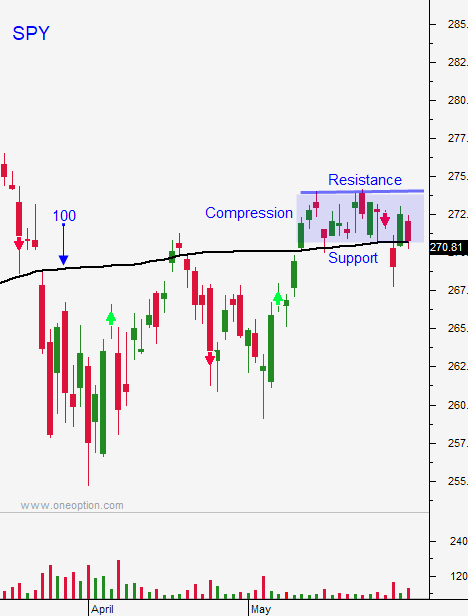

Posted 9:30 AM ET - The market has been able to close above the 100-day moving average for more than a week and it has broken through horizontal resistance at SPY $274. Traders are focusing on strong fundamentals and they are less concerned with political events than they were a few months ago. The summit with North Korea next week and a Fed rate hike have not deterred buyers.

I believe the North Korean summit is critical next week and it will lay the framework for trade negotiations with China. If China is willing to keep pressure on North Korea it will keep Kim Jong-Un "at the table". Denuclearization of the Korean Peninsula is the top priority for Trump. If he can achieve this he will be willing to make trade concessions with China. Once a trade deal with the world’s second largest economy is finalized, other countries will be pressured to negotiate.

If the summit with North Korea is a farce relationships will deteriorate quickly. President Xi has met with Kim Jong-Un and the tone changed instantly. Trump recognized this and he canceled the summit. He will not be played. If North Korea comes armed with demands the summit will not go well. Trumps wants complete submission and I don’t know if he will be satisfied.

Yesterday China and the US flexed their military muscle in the South China Sea over disputed islands. The market did not flinch, but this is not a good omen.

The EU is going to impose new tariffs on the US. This retaliation is aimed at aluminum and steel tariffs that were placed on imports from Europe. This news will not be market friendly when it hits.

The Fed will hike rates next week. Traders are expecting the news and this will be market neutral as long as the FOMC statement is not hawkish. Officials have been pointing to accelerated tightening in 2019 and this could be problematic for the market.

Stocks are oblivious to the dark clouds that loom. I believe that a lightning strike is possible and I'm keeping my overnight exposure to a minimum.

Swing traders are long QQQ calls around the $174.40 level. Use an intraday stop of $174. Ideally, we will get a few more days of positive price action heading into the summit. Once we have that cushion we can raise our stop to our entry price. If we get a lightning strike we will stop out and we will break even. If the summit goes well and the market rallies we will participate in the move. This strategy limits our downside and it gives us unlimited upside.

Day traders need to wait for a pullback or a dip. Buy stocks once support is established. The trading range is tight during the day so set passive targets. If the market flat lines and it rallies above the first hour high you should buy that move. Trim your size and reduce your trade count.

Ahead of the summit Trump's tweets should be friendly and the market will grind higher.

.

.

Daily Bulletin Continues...