Fear Of Missing Out Will Push the Market Higher If QQQ Makes A New High

Posted 9:30 AM ET - The market wants to rally and trade wars are not currently a concern. Either Asset Managers feel that they will not come to fruition or they are completely focused on earnings season. Regardless, stocks keep moving higher and the bid is strong.

The US imposed tariffs on our trading partners and many have retaliated. China is the biggest concern and the rhetoric could escalate now that talks with North Korea have encountered a speed bump.

The economic data points last week (ISM manufacturing, ISM services, ADP and the Unemployment Report) were excellent.

Earnings season begins this week and big profits are expected. Guidance has been fantastic. The market has not advanced in the last quarter and stocks are growing into their valuations. At a forward P/E of 16 there is room to the upside. Industrials and financials have been pounded due to trade war concerns. They are likely to bounce.

The FOMC minutes were released last week and the sentiment is hawkish. That did not dampen investor spirits.

Swing traders are long IWM calls from the $166 level. Stop the position out if IWM closes below $167.

Day traders need to make sure that the opening rally holds. Gaps higher have been vulnerable to profit-taking. Signs a reversal will show themselves in the first hour. If prices are stable the market will grind higher. I will favor the long side.

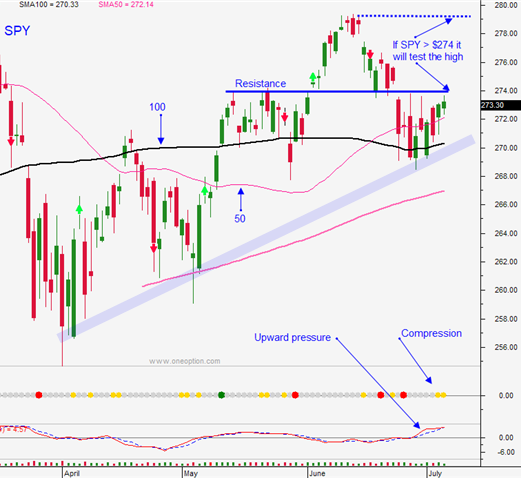

Many Asset Managers have been reducing risk. This move higher will explode if key induces breakthrough horizontal resistance. Under-allocated investors will aggressively buy and FOMO (fear of missing out) will fuel the move.

Stay long.

.

.

Daily Bulletin Continues...